Mortgage

Loan Origination System

Digital mortgages have rapidly evolved into a tangible reality, substantiated by studies revealing the impracticality and complexity associated with traditional analog mortgages in today’s consumer landscape. In our digitized era, we naturally anticipate a seamless path to homeownership, akin to the convenience of ordering a pizza or making online purchases.

Discover

Product Details

ApPello’s Mortgage Loan Origination System delivers a comprehensive digital journey for your customers, spanning the entire spectrum of the process, from application submission to disbursement and ongoing monitoring.

Real-time updates and notifications empower customers with clear insights into their application’s status, ensuring transparency across the entire procedure.

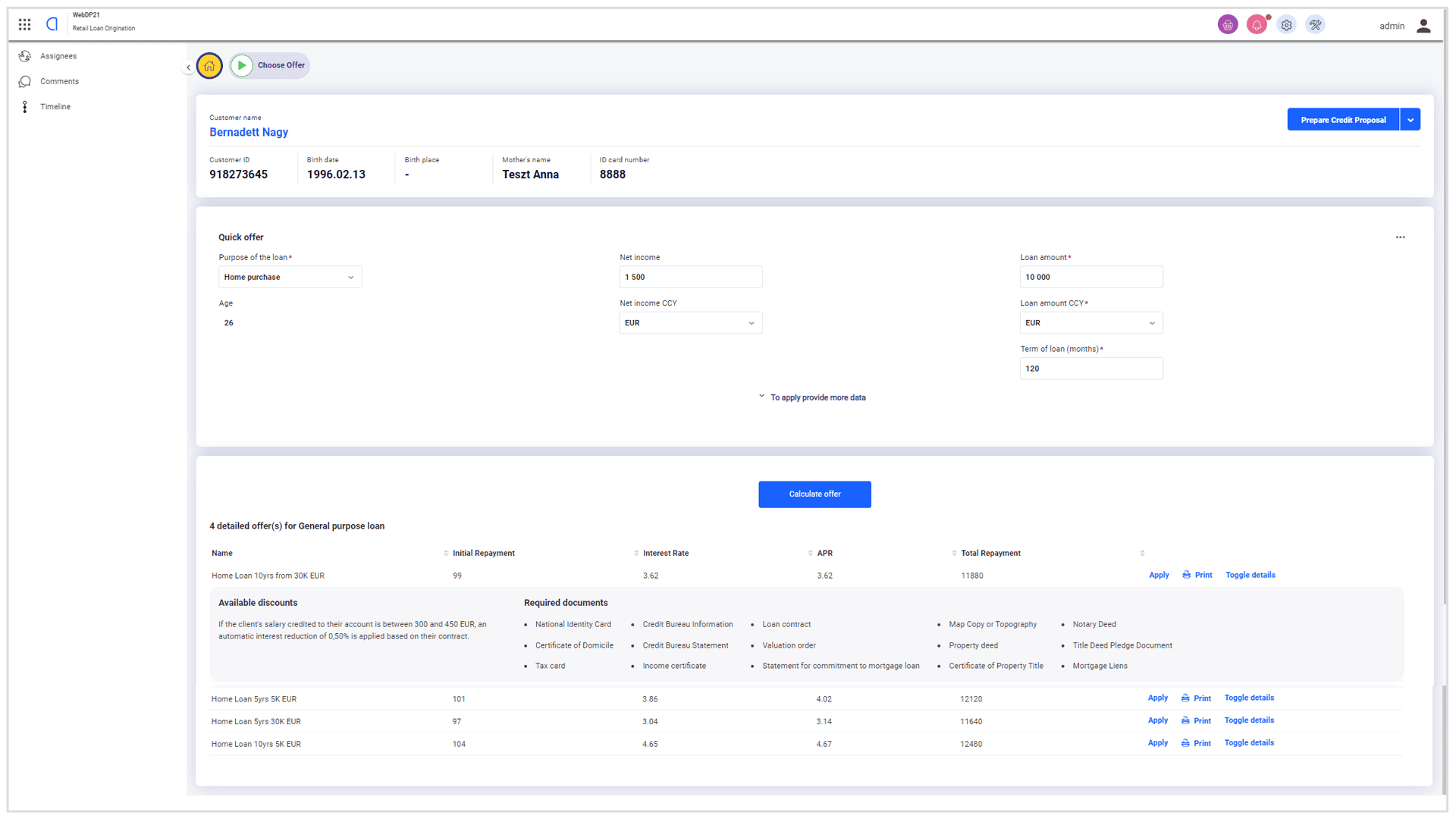

With ApPello’s Mortgage Loan Origination Solution, banks have the capability to present customers with product recommendations and an interactive selection tool, enabling them to make informed decisions and choose the optimal mortgage option tailored to their specific needs.

The Loan Origination System is a technologically crafted innovative tool, based on our modern, low-code microservices platform.

Benefits

Improved sales effectiveness with omnichannel capabilities and an enhanced customer experience

Cost reduction with optimised processes, a flexible toolset, changeable rules, screens, dataset workflow

Shorten origination processes through the use of automation, document management and integration

Enhanced customer experience with face recognition and

e-signature

Monitoring and reporting tools ensure process efficiency for lower operational and credit risk

Prompt reaction to market needs

End-to-End

support of LOS

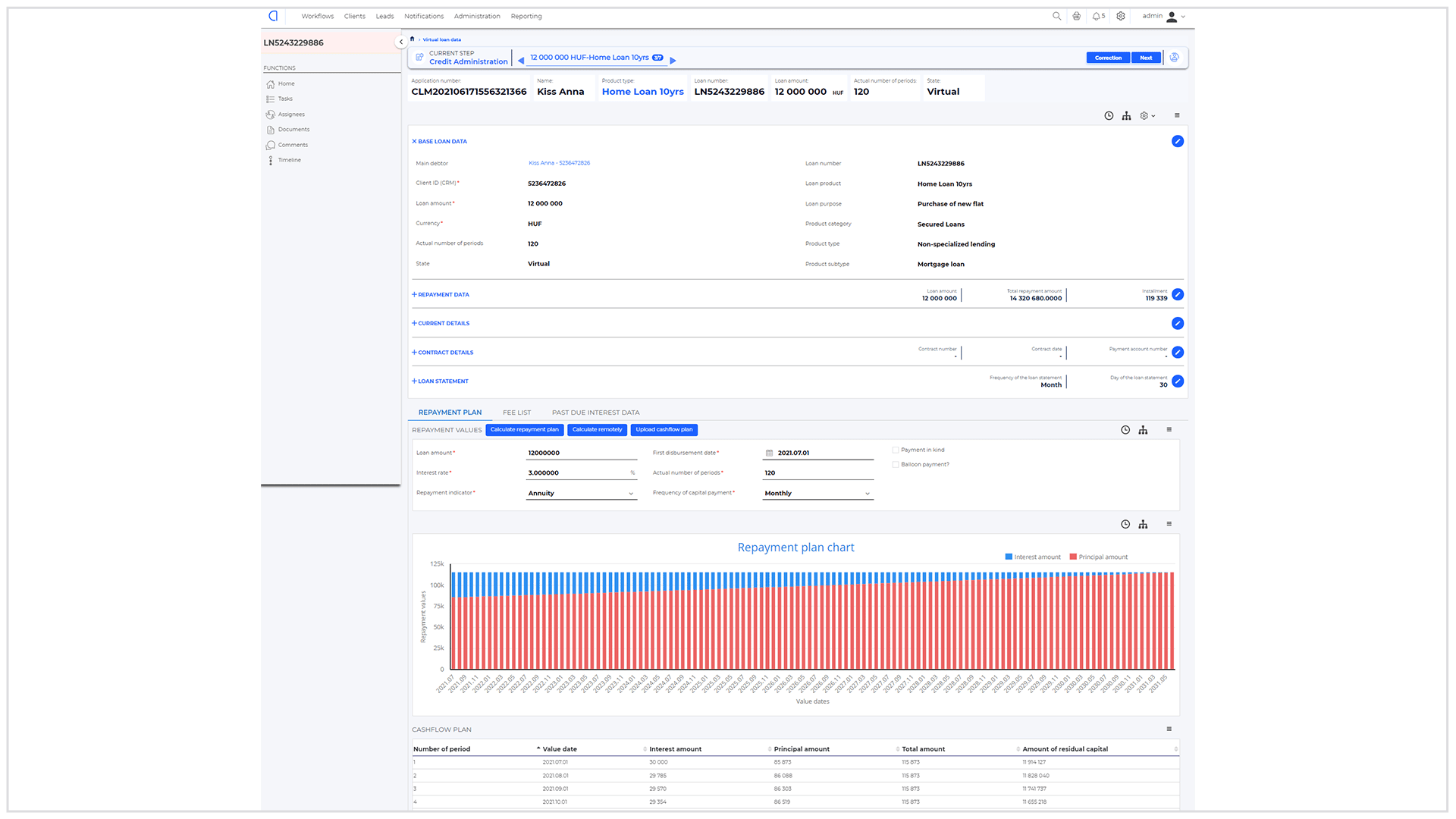

The ApPello Mortgage Loan Origination System is a comprehensive solution that encompasses the entire lending process, starting from the initial engagement with prospective borrowers, extending through disbursement, and throughout the entire credit lifecycle. This includes handling waivers, prolongation, restructuring, termination, and ongoing monitoring. All of these processes are efficiently managed through the use of standard Camunda BPM within ApPello’s platform.

This system serves as a centralized hub, integrating client onboarding, loan origination, credit workflow, risk assessment, decision-making processes, and all associated loan administration tasks. It is designed as a modular solution, making it adaptable to the unique needs of complex banking environments, where it has been successfully implemented.

With various front-end options catering to different application purposes, the ApPello Mortgage Loan Origination System streamlines the lending workflow. It seamlessly integrates both front-end and back-office systems, resulting in an expedited credit application process and a superior customer experience. Our primary development focus has been on reducing the time-to-decision for our in-house users and the time-to-money for our valued bank clients.

Workflow of Mortgage Loan Origination

Onboarding

- Register client in CRM

- Sign up / Sign out

- Login & Password management

Acquisition

- Portal for customers and agents

- Product selection

- Informing clients

- Documents

Origination

- Repayment plan and APR calculation

- Covenant handling

- Checking KO criteria

- Collateral handling

Scoring

- Set up configurable scorecards (optional)

- Limit calculation

- Track scoring result

- Initial repayment plan

Decision making

- Track decision results

- Integration to Credit Bureau, TAX database

- Decision administration

Contracting

- Document checklist

- Contract generation

- Signature

Disbursement

- Configurable disbursement conditions

- Checking conditions

Early warning and Monitoring

- Soft / Hard collection support

- Early Warning option

After care

- Up/Cross-sales opportunities

- Waivers

- Prolongation

- Restructuring

- Termination

Mortgage Loan Origination System

Functionality

The Mortgage Loan Origination System is supported by the following critical components to support the end-to-end loan processing:

- Loan application management

- Pre-screening of applications

- Collateral management

- Covenant management

- Document management

- Non-financial analysis

- Dynamic questionnaires, scorecards

- Risk based pricing

- Monitoring

- Restructuring

- Prolongation

- Termination

Simplified & user-friendly

loan application process

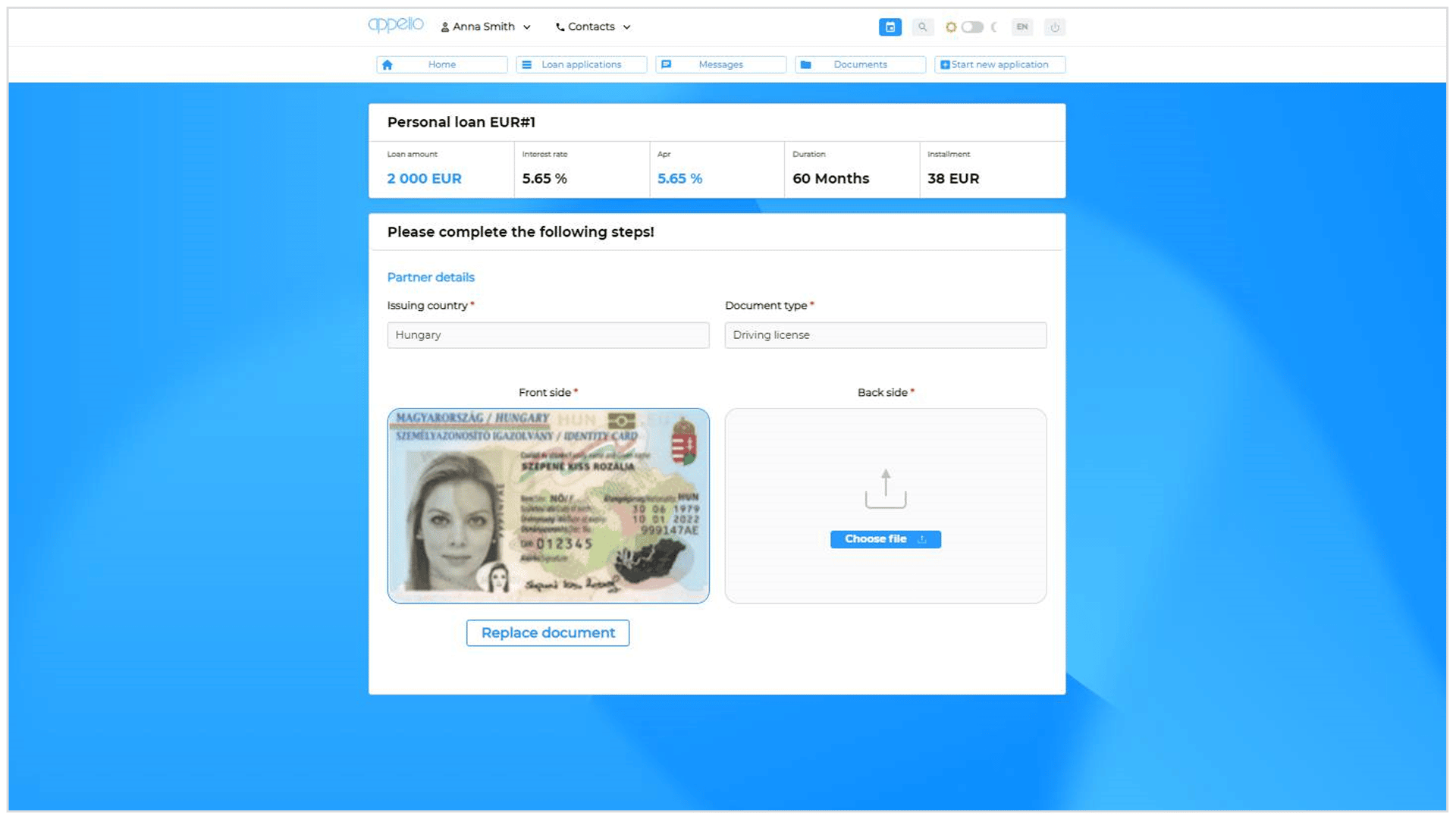

The Mortgage Loan Origination System offers customers an easy and friendly way of providing the required information for their mortgage application. Through integration with third-parties and data aggregators, the bank can obtain most of the information required for the loan application, thus minimising the effort on the customer’s part. In addition to the increased customer convenience, the bank benefits from lower processing costs, higher data accuracy and lower operational and fraud risk. In the process of collecting additional information, customers are presented with user-friendly forms that organise the information into small sections that are easy to fill, helping them to be in control, thus increasing the pull-through rates and encouraging progress.

Product recommendation &

personalisation engine

Once applicants have furnished their initial information, the system presents them with comprehensive details of recommended loan products. Moreover, it offers personalized alternatives, tailored to meet individual needs. This thoughtful approach assists customers in making informed decisions and selecting the most suitable loan product, ultimately resulting in heightened customer satisfaction and a streamlined, efficient sales process.

Transparent & smooth

lending journey

The Mortgage Loan Origination System is designed to establish smooth and outstanding borrower experiences through its innovative features:

- The front-end portal facilitates real-time communication between clients and the bank, ensuring a seamless and expedited origination process.

- Users have the capability to input essential information, submit necessary documents to the bank, kickstart property valuation procedures, and engage in messaging for all loan application-related inquiries. This comprehensive functionality enhances convenience and efficiency throughout the loan origination journey.

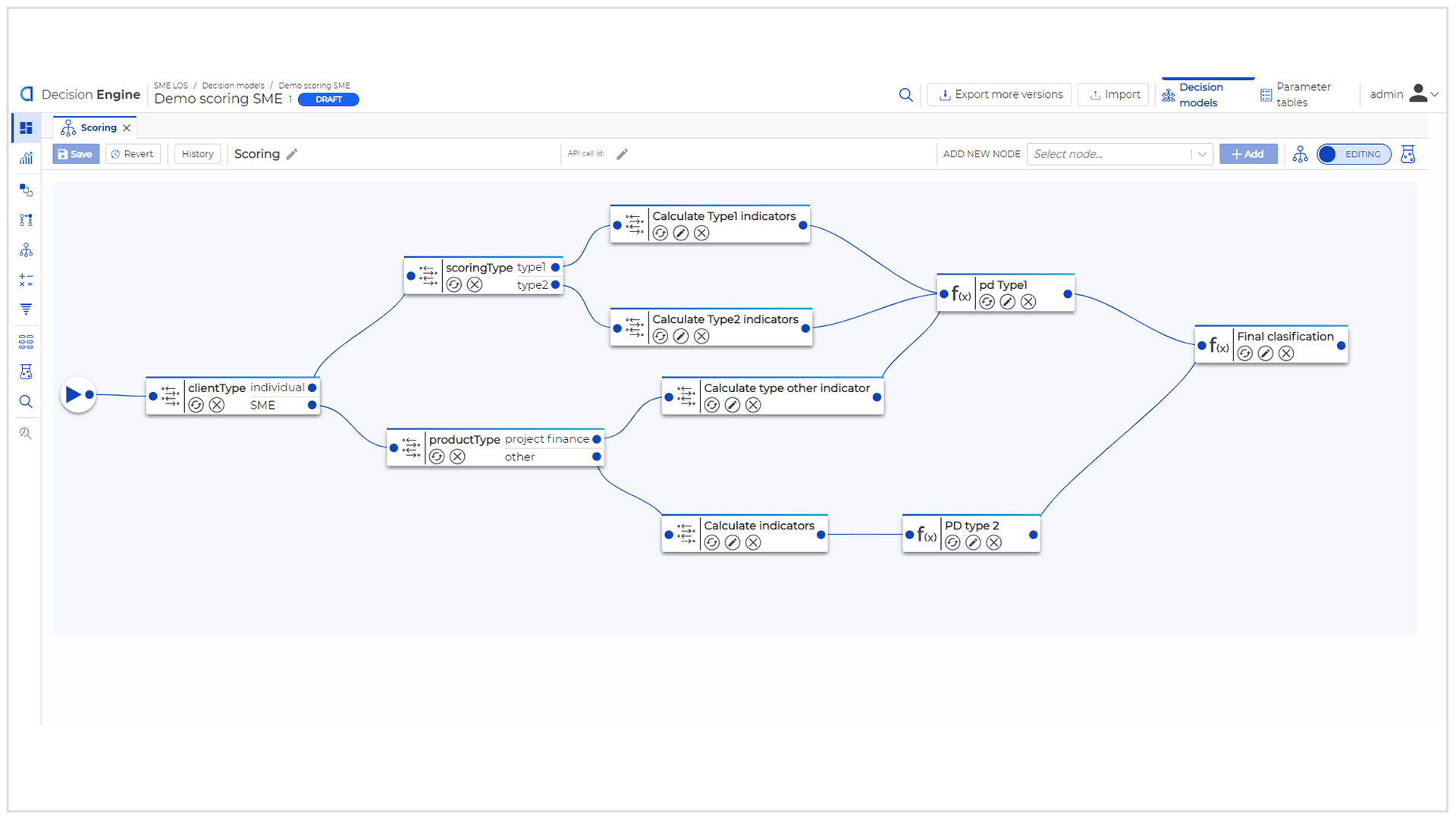

Decision

Engine

The integrated Decision Engine serves a multitude of functions including pre-screening, classical scoring, rating, limit computation, and the management of supplementary decision junctures. It boasts the capacity to accommodate an extensive array of distinct decision logics, each tailored to specific customer segments (including sub-segments), products, and product variants. The model variants can be further refined based on specific products or client sub-segments.

Business rules and decision logic, accompanied by user-friendly graphical representations, can be meticulously constructed and personalized by the bank’s staff members in relevant roles, even in the absence of intricate IT expertise.

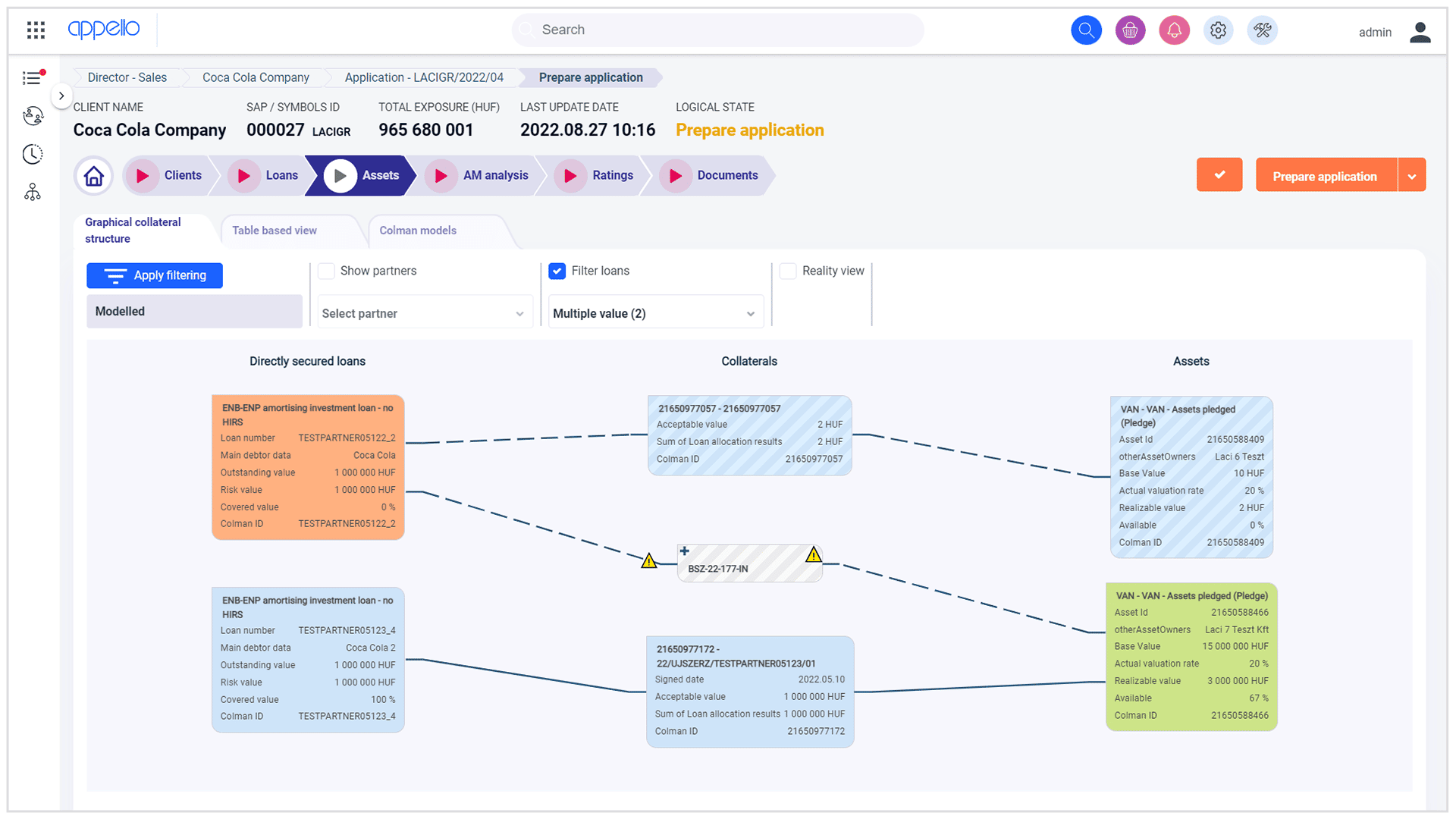

Managing

Collaterals

In the loan origination process, having a comprehensive view of existing loans and collaterals is crucial. Our System simplifies this task by enabling easy entry of obligations and collateral data through a user-friendly interface. Additionally, you can effortlessly import data using standard APIs, further enhancing efficiency. Need to include supplementary data? No problem! Our system allows seamless entry for any selected collateral.

Key Features:

- Hassle-free Collateral Input: Enter obligations and collateral data effortlessly using our intuitive screen interface, ensuring accuracy and speed in the loan origination process.

- Seamless Data Import: Save time and effort by importing data via standard APIs, allowing for quick integration and minimizing manual data entry.

Supplemental Data Flexibility: Customize your collateral records by adding supplementary data as needed, providing a comprehensive view for better decision-making.

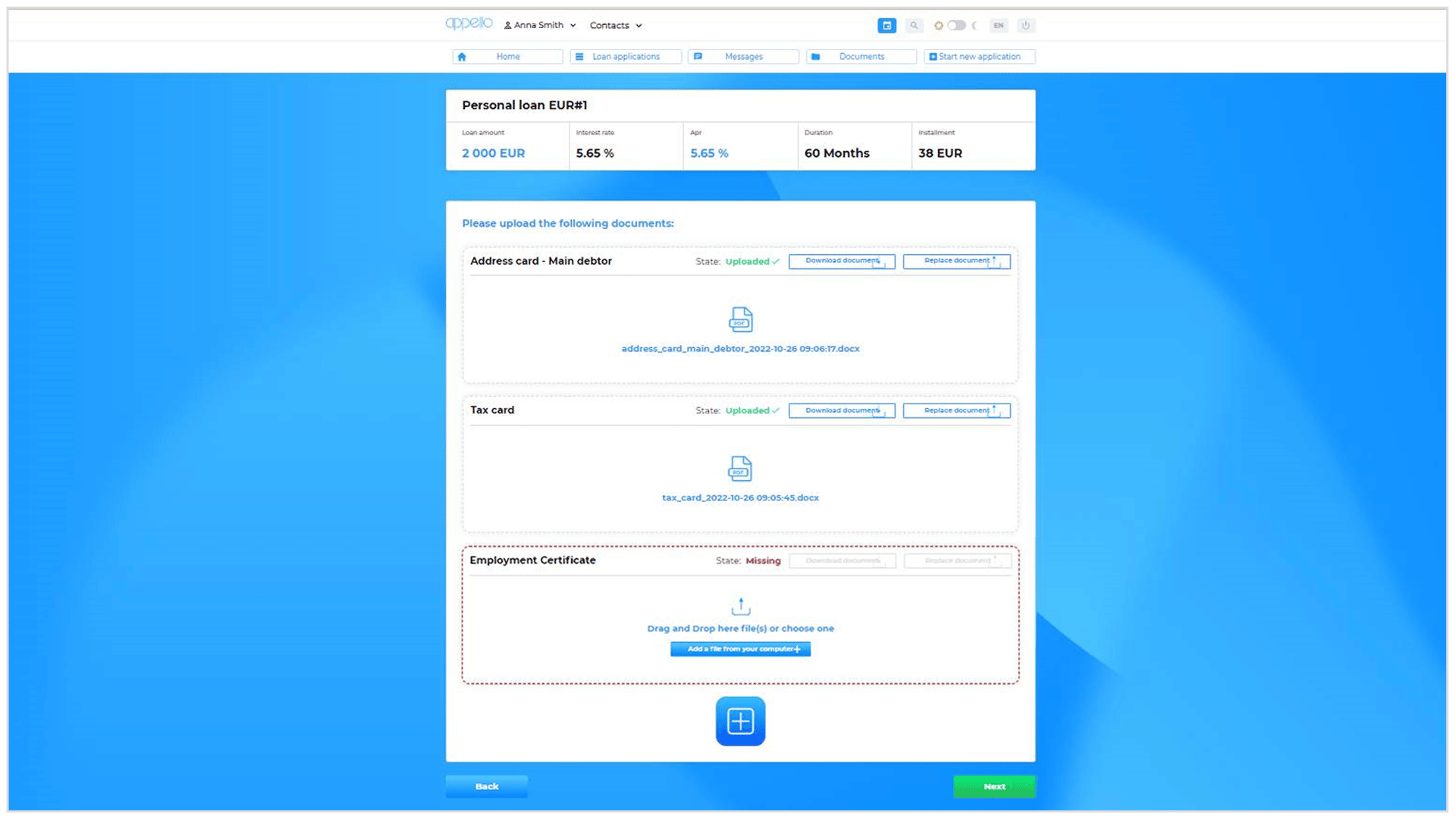

Documents &

Contracts

The ApPello Portal streamlines processes through automated document uploading, creating an entirely paperless and bureaucracy-free experience. Defining document requirements has never been more effortless.

Moreover, the portal seamlessly delivers prepared proposals, contracts, and more to clients. The inclusion of document management functionality simplifies tasks like document creation, storage, retrieval, and search. A seamlessly integrated digital signature function adds the finishing touch to this paperless workflow.

Within the LOS Solution, the Document Template Module and Document Store Module work in unison. The Document Template Module effortlessly handles various contract types, generating them automatically using MS Word templates.

Leveraging document management tools, a diverse range of documents can be swiftly generated based on templates, and subsequently populated with pertinent data available within the system. This proves invaluable, saving both time and effort within the loan origination process. Every aspect of the necessary paperwork, from loan proposals and contracts to notifications and statements, can be prepared efficiently. The digital signature feature adds an extra layer of assurance, verifying the integrity of contracts and agreements.

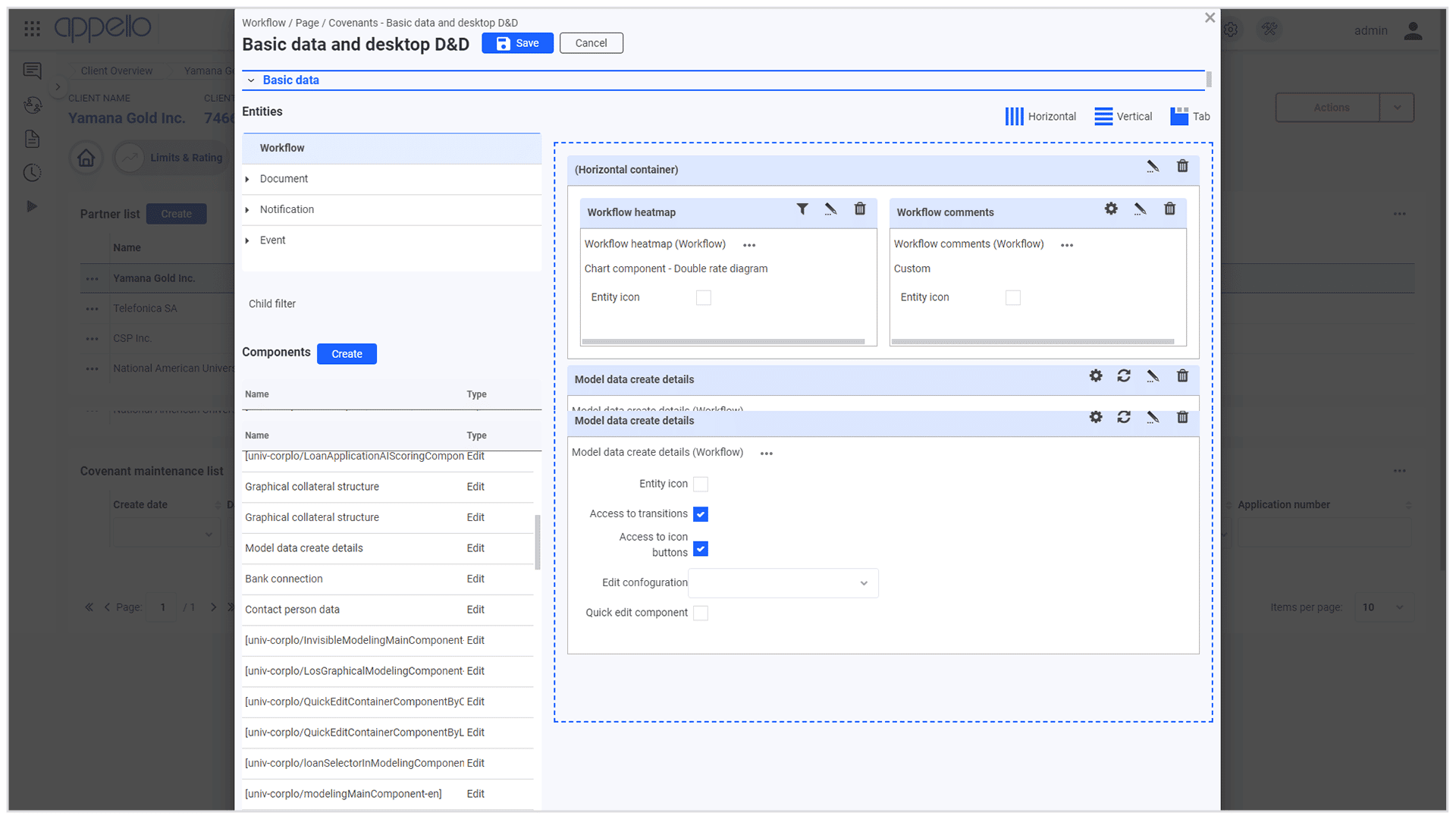

Configuration

over customization

The ApPello Loan Origination System empowers proficient users to exert comprehensive control over and tailor the entirety of lending-related workflows throughout their complete lifecycle. The integrated editor interfaces enable the definition of an unlimited variety of workflow types. Diverse workflows can be crafted employing distinct workflow steps, all without the need for ApPello’s involvement or IT team intervention. Parametrizing the prerequisites and conditions for the completion of these workflows is an effortlessly achievable task.

Flexibility extends to parallel tasks, which can be shaped based on real-time parameters. These tasks can share identical or distinct assignees and be executed in any sequence dictated by the specific parameters in place.

Furthermore, the system offers an array of additional configuration opportunities:

- Screen design

- Dynamic fields

- Additional business rules

Collectively, these features provide a versatile and powerful toolkit for banks to finely tune and optimize their lending operations.

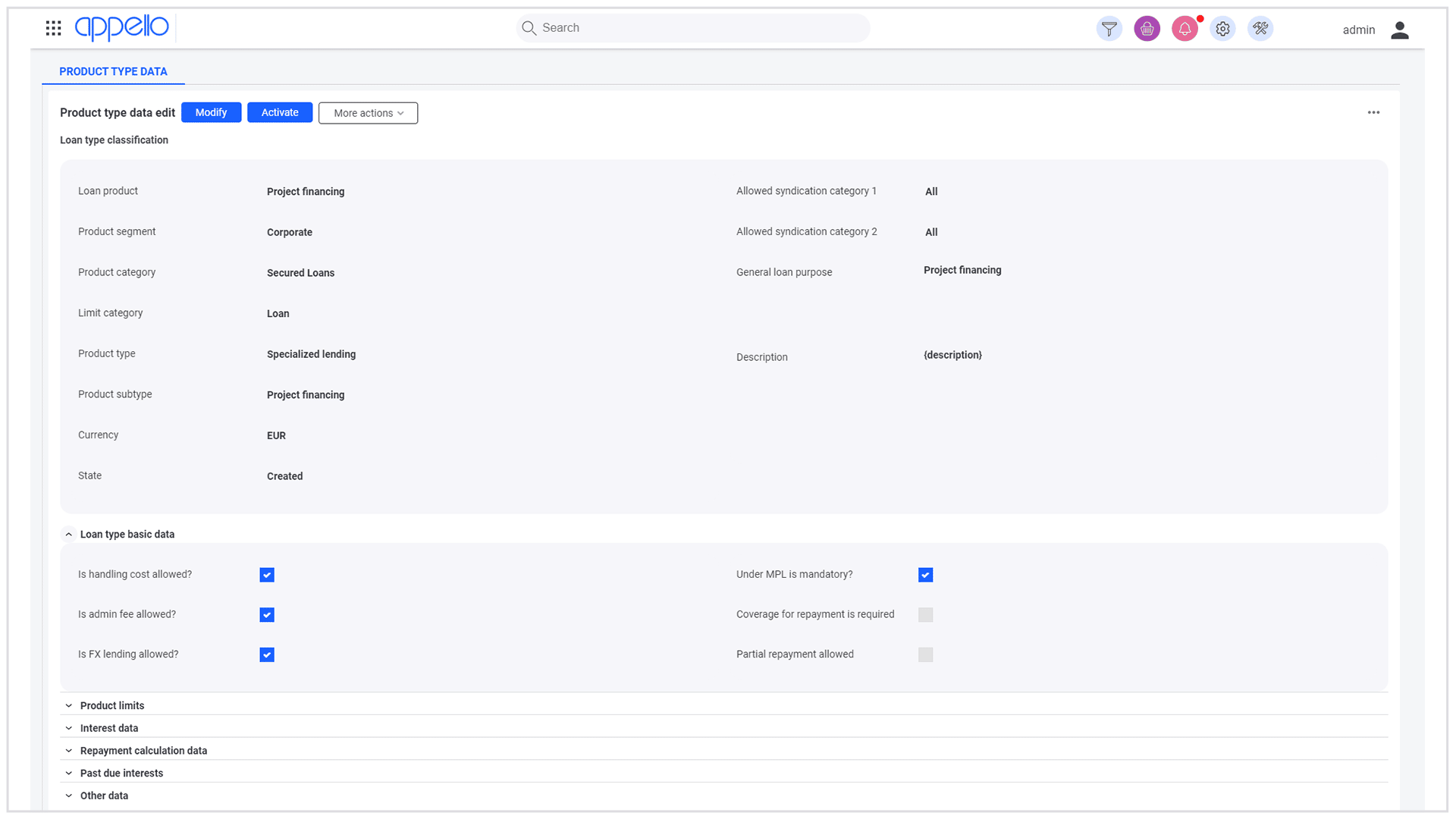

Business

Configuration

The ApPello Loan Origination System provides adept users with the authority to wield comprehensive command over and customize every aspect of lending-related workflows, spanning their entire lifecycle. The integrated editor interfaces empower the creation of an endless spectrum of workflow types. Varied workflows can be detailed crafted utilizing unique workflow steps, all devoid of the necessity for ApPello’s involvement or IT team engagement. Tailoring the prerequisites and criteria for the fulfillment of these workflows is a task easily accomplished.

In addition, the system encompasses a spectrum of supplementary configuration prospects:

- Product catalogue

- Covenant catalogue

- Document type catalogue

Together, these attributes furnish banks with a versatile and potent toolkit, facilitating the precise calibration and enhancement of their lending operations.

Related

Products

You might also be interested in our other lending solutions

Unsecured Retail

Loan Origination

ApPello Loan Origination System is designed for banks and financial institutions to manage the lending processes of unsecured retail loans.

Decision

Engine

Speeds up and automates decisions. It is a segment and product-independent solution that can handle business-related decisions of varying complexity within a centralised platform.