Collateral

Management

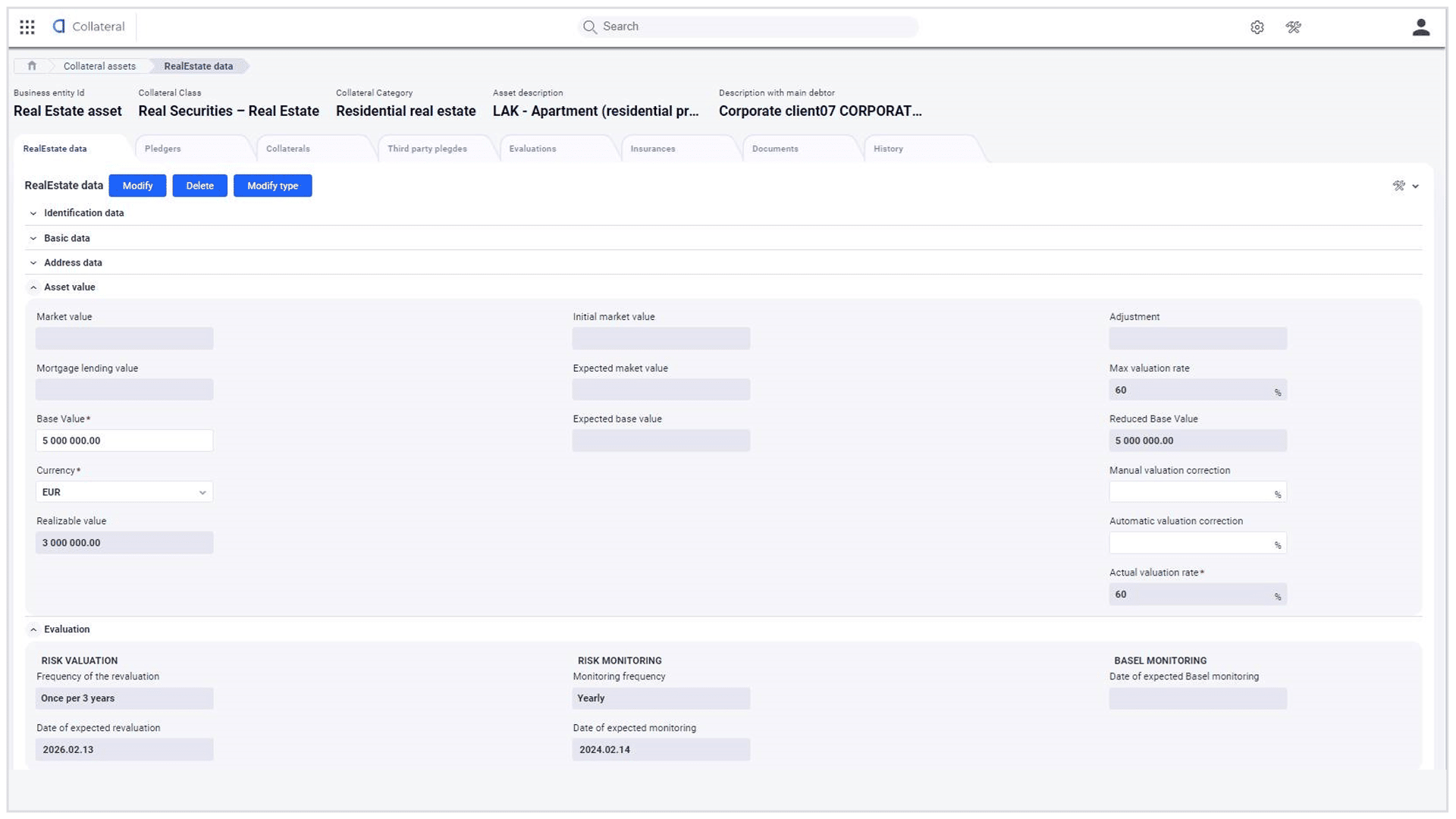

Unlock the power of cutting-edge technology and unparalleled expertise with

ApPello Collateral Management System, a state-of-the-art enterprise-wide solution. Our platform seamlessly integrates advanced technologies, offering financial institutions a flexible, functionally rich, and innovative way to manage complex loan collateralized activities with ease, whether on-site or in the cloud, while also considering Environmental, Social, and Governance ESG principles.

Discover

Product Details

At ApPello, we take pride in offering a fully configurable collateral management solution that covers every aspect of your collateral management needs. From the early stages of loan collateral structure planning and modeling during the origination phase to the complex eligibility calculations,

activation-maintenance-termination-workout processes, segmented activation criteria setup, optimized allocation algorithm, and maker-checker flow – our platform has got you covered.

With Appello, managing collateral is not just efficient; it’s a strategic advantage in building a more sustainable financial future.

Benefits

Improved Sales effectiveness with the functionality called Collateral Loan structure planning / modelling and prompt Allocation calculation

Reduced operating Cost with easily changeable collateral attributes, processes, screens, eligibility rules

Capital efficiency (optimized input for RWA calculation) and optimized Loan loss provisioning with an multiple and intelligent collateral to loan allocation algorithm

Compliance with Basel, Anacredit Regulations

ESG data collection and evaluation

Data consolidation and data quality improvement

Lifecycle-based

Collateral Management

Gain a comprehensive overview of your collateral management processes in one centralized system. With ApPello, you reduce operational risk, as all relevant information is easily accessible and efficiently managed. Navigating the entire lifecycle of collateral has never been easier with ApPello Collateral Management Solution.

The Collateral Management System efficiently manages the related insurance, eliminating unnecessary complexities and ensuring compliance with insurance requirements.

Solution allows the customization of screens, providing a user-friendly experience tailored to individual preferences. The platform incorporates powerful controls to maintain data integrity, minimizing errors, and discrepancies. Be confident in the accuracy of your data. The system sends notifications or pop-up warnings when necessary, allowing you to proactively address critical issues.

Collateral registration

- Modelling new applications changes in loan-collateral structure

- Integration with external LOS

- Checking loan exposure coverage

- On-the-fly allocation

- ESG check

- Policy check

Monitoring & Maintenance

- Daily recalculation and monitoring of loan – collateral structures

- Automated asset revaluation

- Allocation of active loans-collaterals

- Configurable eligibility calculation

- Notifications in multiple formats

Workout and collection support

- Cost & revenue registration

- Financial analysis

- Reporting

Collateral activation

- Individual or bulk contract activation

- Configurable activation criteria

- 4-eyes principle

- Update live loan – collateral structure

Collateral termination

- Manual or automated collateral contract termination

- Automated asset release

- Alerts & warnings

Easy-to-extend

collateral catalogue

ApPello’s Collateral Management offers robust support for a diverse range of collaterals, encompassing 10 primary types, including real estate, movables, guarantees, and more. Within each collateral type, a rich array of categories and sub-categories exists, facilitating precise identification. For instance, under the “Real estate” type, you can pinpoint collateral with utmost accuracy, such as “Residential” or “Family house,” while also customizing key parameters unique to each sub-category. This comprehensive sub-categorization empowers you with the flexibility to tailor collateral details according to your specific needs.

Embracing

ESG Principles

System is enhanced by ESG-related information such as physical risk, physical risk details, location, energy performance, energy consumption, heating source type, etc… With this data, Banks are able to start the assessment of each mortgage, incorporate the ESG-related information in their lending strategy, and understand the physical risks in terms of finance. Besides, Banks are able to introduce preventative measures that could help to mitigate certain risks.

Intelligent

allocation

The true efficiency of collateral management lies in mastering the art of optimal allocation, and at ApPello, we have the solution. Our platform empowers you to determine the most effective way to allocate your collaterals to exposures, ensuring you make the most out of your valuable assets. With ApPello, you gain access to various of built-in methodologies for allocation optimization, providing you with the flexibility to choose the approach that best suits your requirements. This extends to provisions and/or capital allocation, giving you comprehensive control over your portfolio.

System runs allocation optimizations daily, utilizing up-to-date exposure risk values and re-evaluated collateral asset values for your entire portfolio. This ensures that your allocation decisions are based on the most current information available.

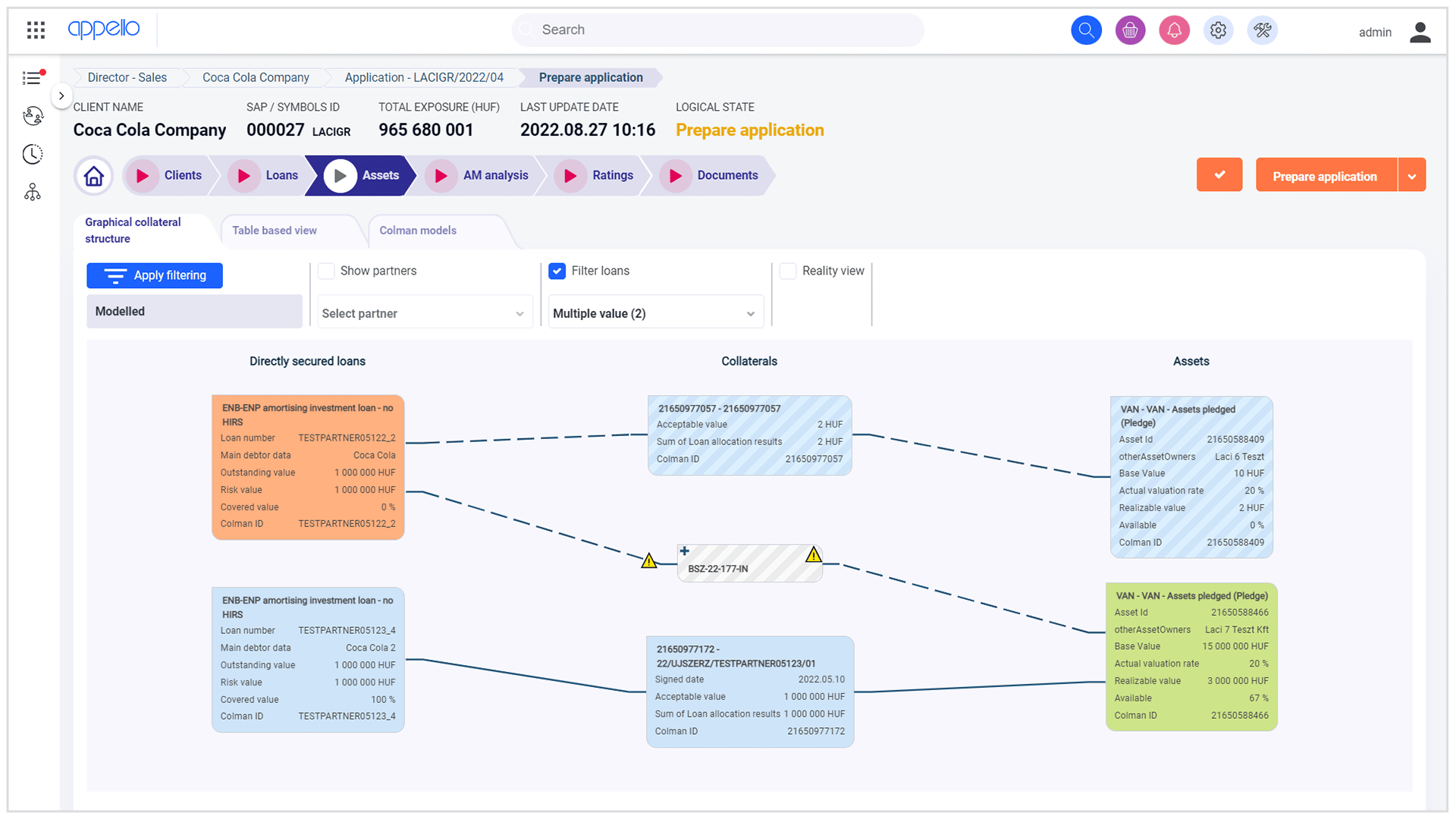

React promptly to customer group needs during daily operations with our on-the-fly algorithm start feature. This empowers you to initiate allocation optimization for specific customer groups or loan-collateral clusters, ensuring quick responses to changing demands.

Discover additional

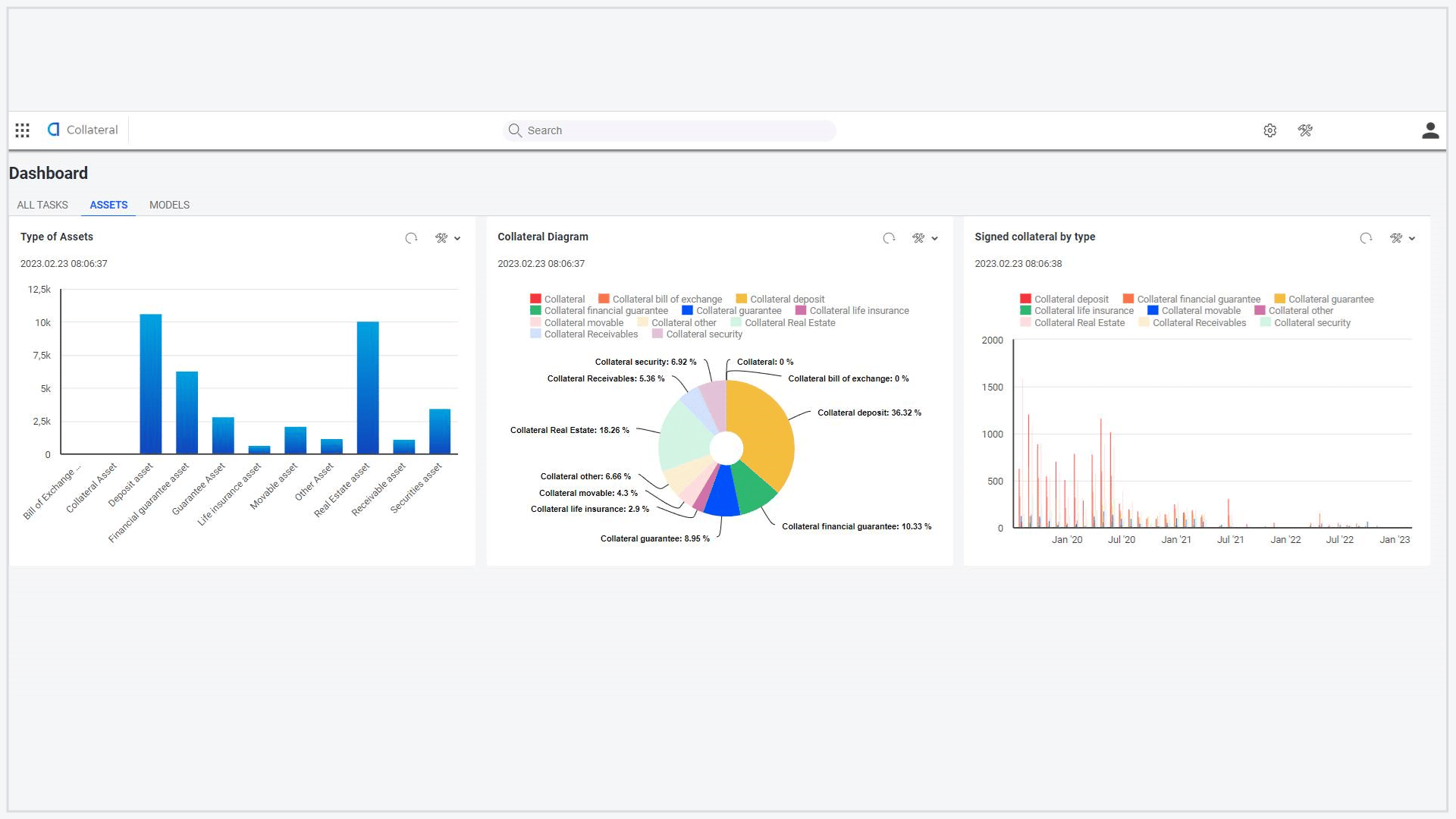

sales potential

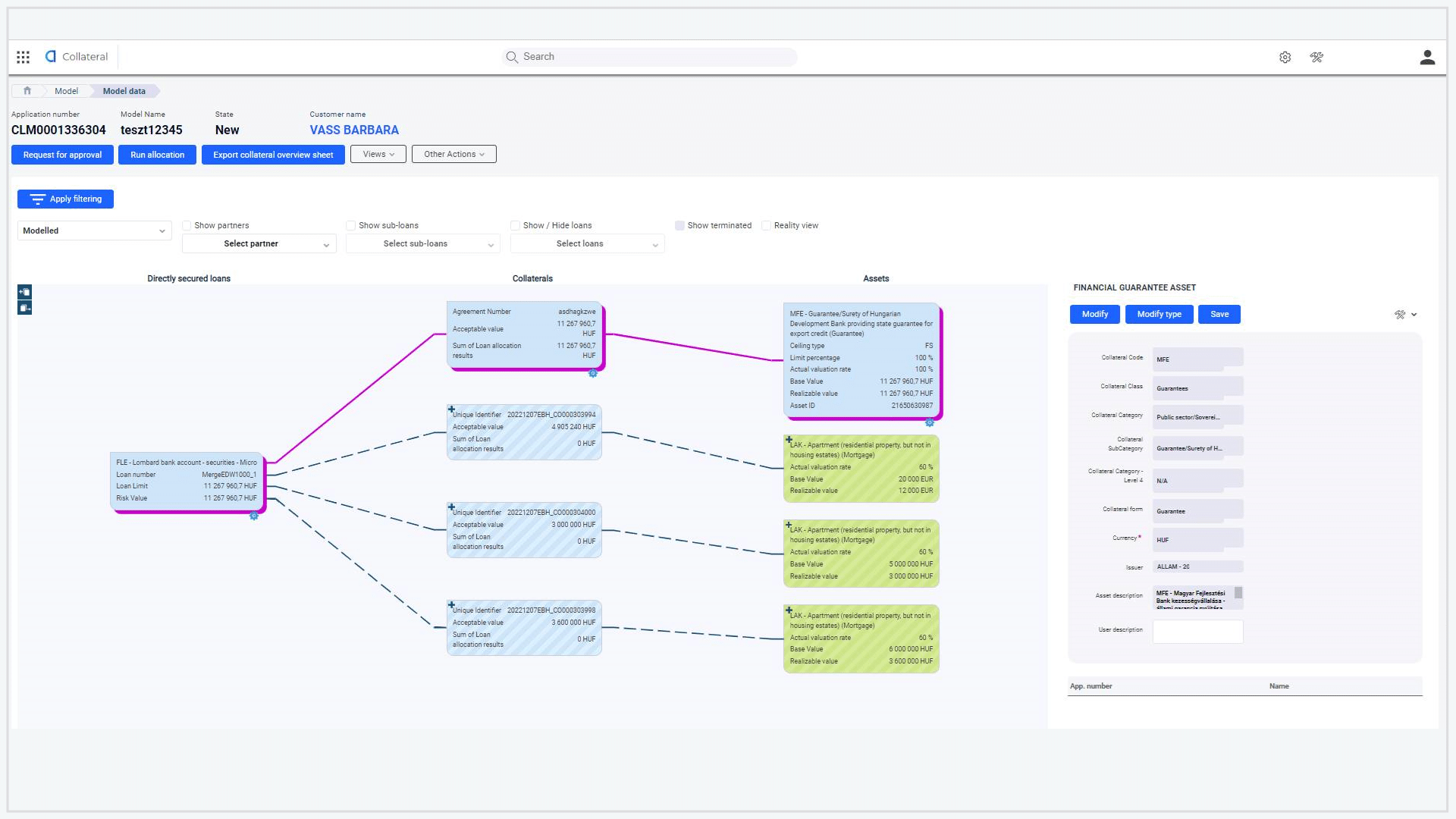

System offers intuitive visualizations of facility-loan-collateral and contract-collateral asset structures and allocation outcomes. These graphical or table-based displays play a pivotal role in executing new actions and streamlining maintenance tasks.

With clear graphical representations, our platform simplifies executing new actions, such as sandbox calculations for incorporating fresh collateral into the financing structure. Performing maintenance tasks, like replacing existing collateral with new assets.

The System empowers you to identify complex business scenarios and uncover valuable opportunities. From handling cross-collaterals between diverse partners and facilities to managing portfolio guarantees and collateral replacements, we ensure you stay ahead of the curve. Customer-Centric Advantage: Recognize your customers’ needs firsthand and gain a significant competitive edge.

Comply with

Basel & Anacredit

In the face of ever-evolving regulatory norms, compliance with Basel regulations and new introductions like AnaCredit has become increasingly crucial. ApPello’s Collateral Management solution not only guarantees adherence to these standards but also empowers our clients with a comprehensive flexibility toolset, putting them in complete control of their application settings and significantly reducing IT maintenance costs.

With our solution, dedicated business users can effortlessly configure eligibility and enforceability rules, allowing for tailored adjustments. Additionally, setting up and maintaining the collateral catalogue, along with all pertinent business parameters, is made simple and efficient.

Related

Products

You might also be interested in our other lending solutions

Real estate

Valuator

is a workflow-engine driven application supporting the evaluation of the real estates and movables.

10+ types of workflows and 5 valuation methods supporting on-site and back-office processes.

Mortgage

Loan Origination

ApPello Loan Origination Solution is an advanced end-to-end tool providing an efficient and profitable relationship between the bank and the borrower.