Early Warning &

Monitoring

ApPello’s Early Warning & Monitoring system serves as an ideal instrument for promptly identifying any disparities in loan repayments, enabling timely interventions to proactively address potential challenges.

Discover

Product Details

In addition to conventional credit monitoring, this solution actively facilitates the swift management of emerging concerns by initiating policy actions at the onset, effectively preventing any further decline in a client’s financial condition.

The inbuilt monitoring component enables the seamless and routine evaluation of the entire loan portfolio.

Benefits

Early identification of non-performing loans, efficient credit monitoring

Parameterizable alerting mechanism, Automated detection of early warning signals

Classification, segmentation and strategy management

Action plans and risk intervention management

Provision and RWA mitigation, asset quality and solvency improvement

Expert estimation of risk categorisation (Loans, Customers)

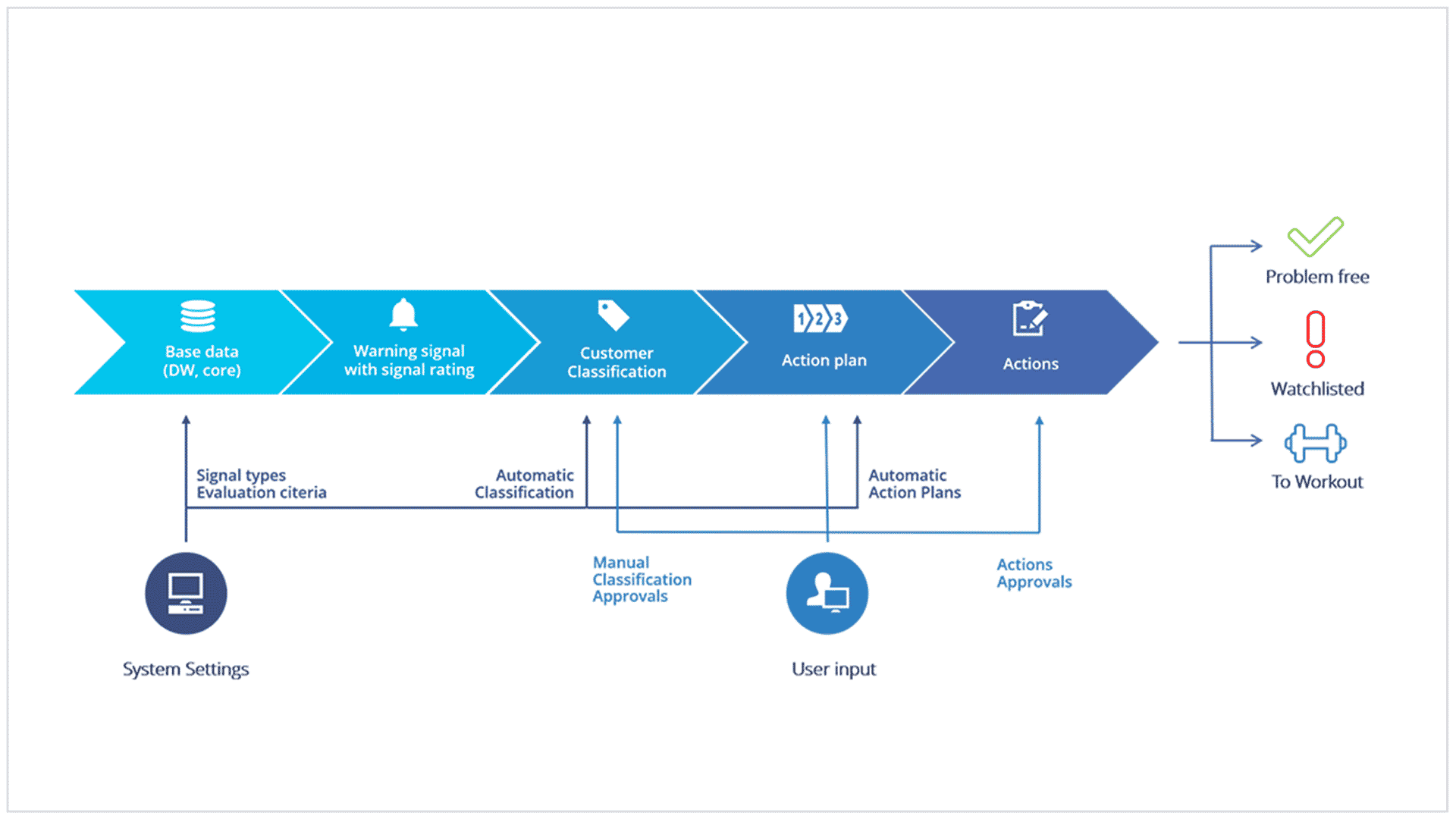

Early Warning

System

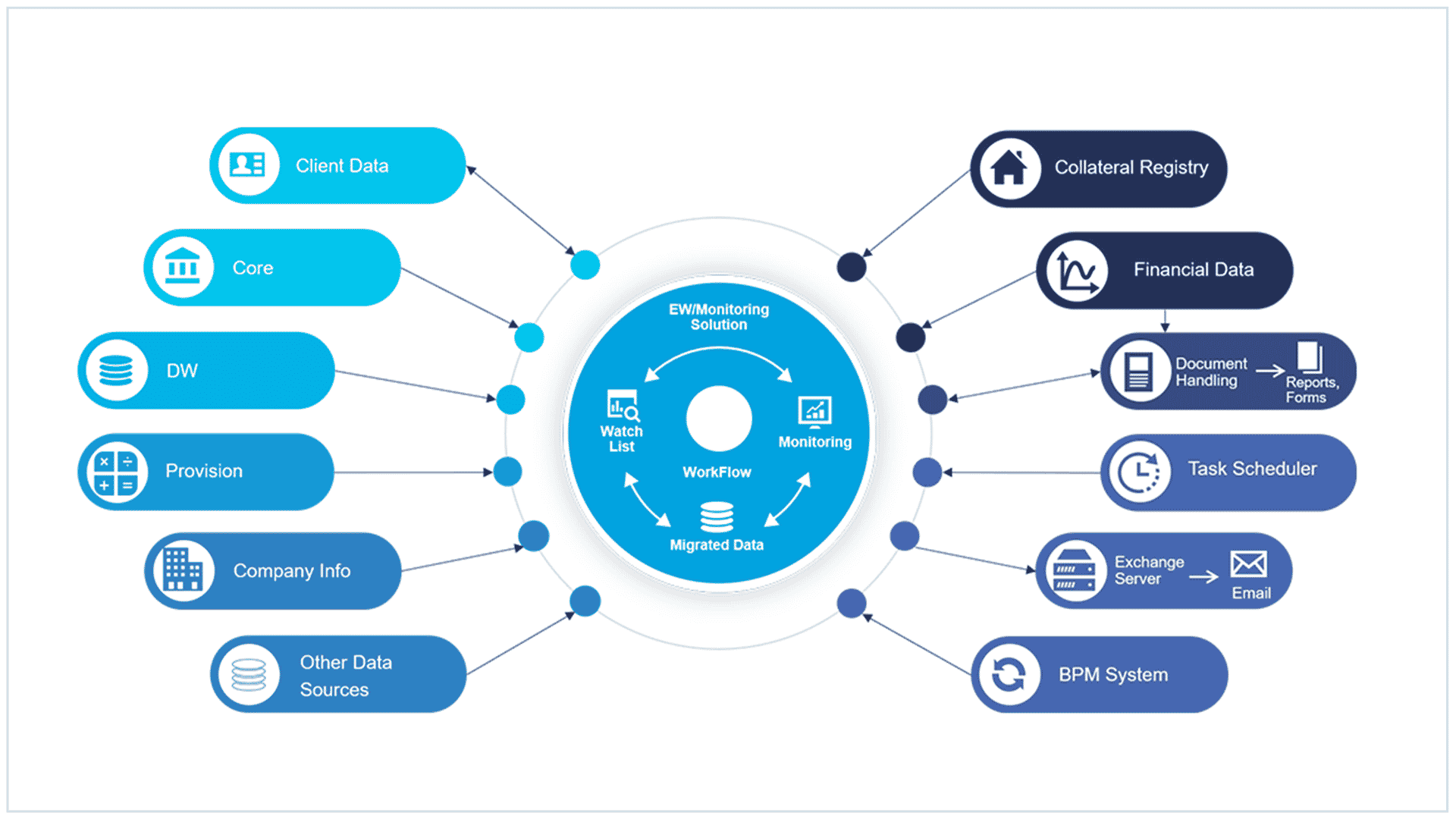

Data gathering

- Internal data sources

- External data sources

Warning signal

- Configurable signal definition

- Automatic / manual generation

- Configurable signal rating

Customer/Loan classification

- Evaluation of signals

- Automatic risk evaluation

- Manual adjusment

Action plan

- Configurable action catalogue

- Automated action planning

- Action plan classification

Action

- Task execution

- Customer/Loan evaluation

- Outcome: Problem free/Watchlisted/Workout

Statistical based flexible

Early Warning calculation engine

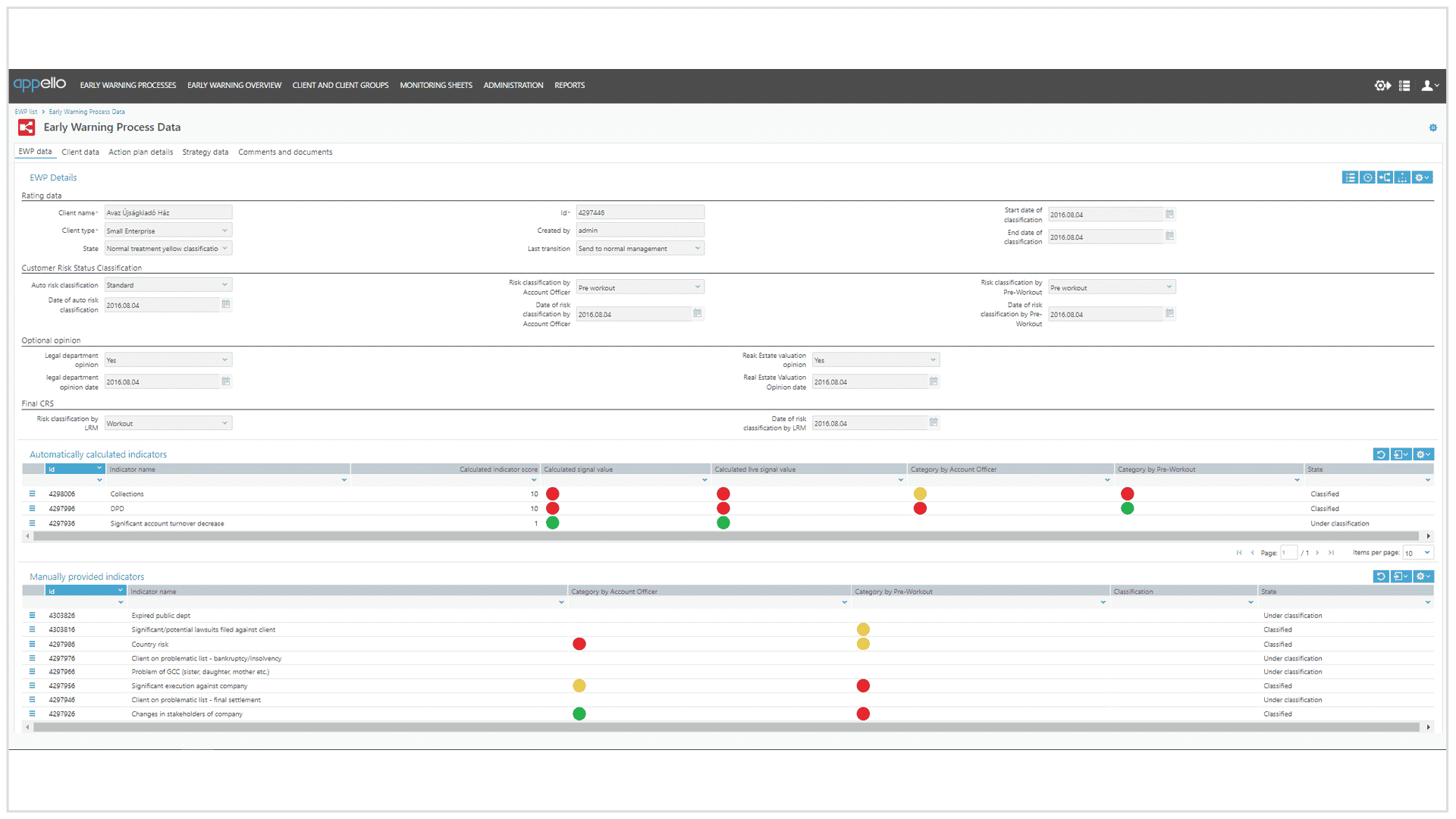

The system operates using a personalized and expandable collection of early warning signals, which can be automatically or manually generated. The specifics of monitored data, the criteria for automatic signal generation, and the severity of each signal are all governed by business rules, easily parameterized by Power users. These signals might encompass factors like reduced account turnovers, delayed payments, alterations in client ratings, or data from an external credit blacklist, among others.

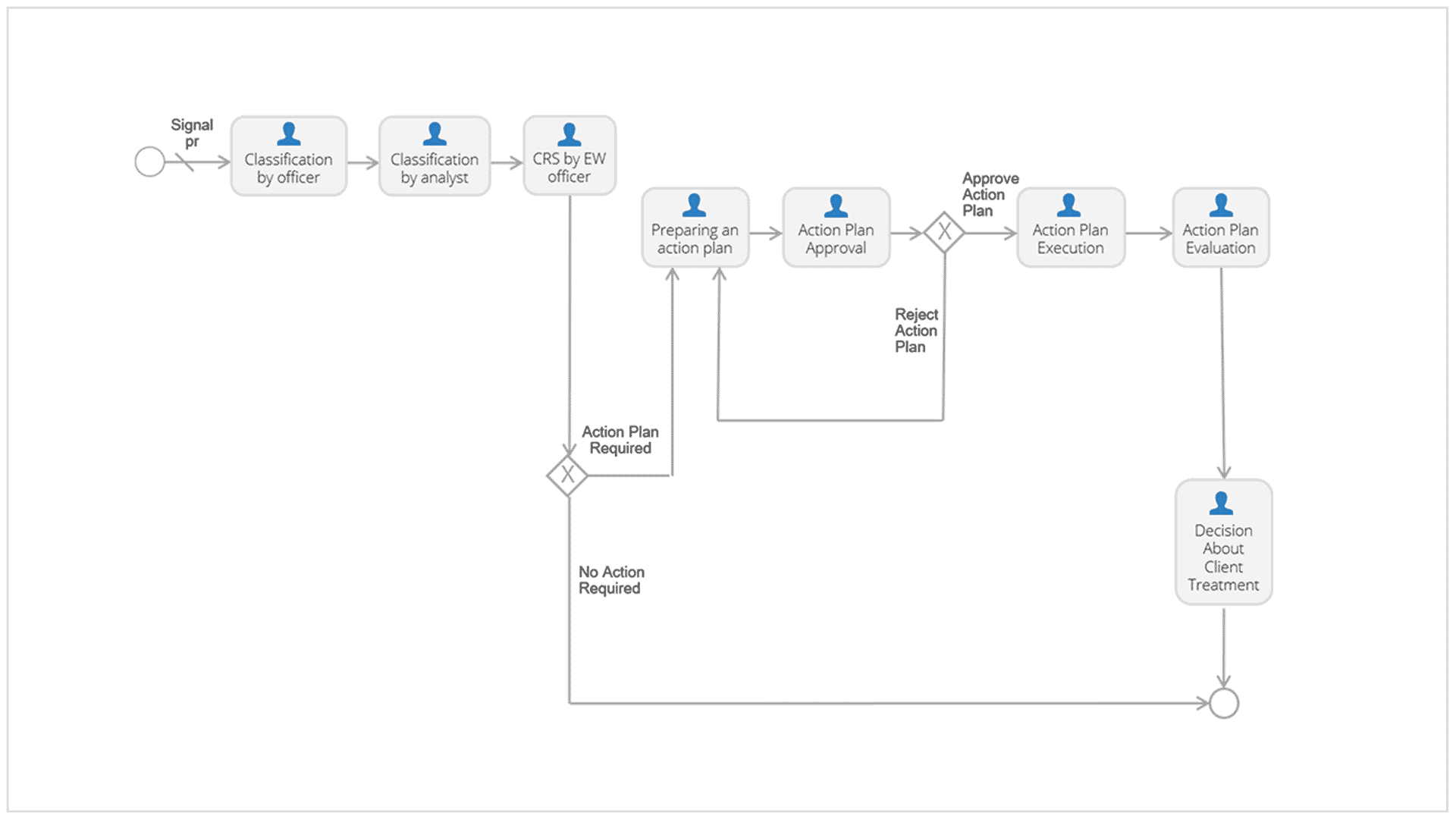

Workflow based

escalation process

The classification process initiates automatically, driven by business rules that assess the warning signals and suggest an initial client rating. In tandem, business and risk management specialists contribute their evaluations, which further inform the client’s rating and subsequently guide the development of an action plan. Following the rating stage, the system employs an approval process to determine the necessary course of action. Decision-making benefits from a comprehensive 360° client overview, enriched with client group insights, ensuring a well-informed approach.

Action plans and handling

of risk mitigation tasks

Beyond the mere identification of issues, the system takes charge of their resolution through the formulation of adaptable action plans, devised according to the indicator signals. This entails the generation of fresh tasks for each action, often involving a process of reevaluation (rerating). The system then meticulously oversees the allocation, execution, and subsequent reevaluation of these tasks, ensuring a thorough and well-monitored progression.

Integrated loan monitoring

module

The Monitoring module adeptly fulfills the regulatory mandate for routine client assessments. Through automated processes, the system generates monitoring sheets encompassing client details and exposures, subsequently assigning them to designated users for assessment. Within these monitoring sheets, each client’s exposures receive individual ratings, and the approval process is diligently shepherded by a guided workflow.

AI

Engine

ApPello’s AI Engine plays a pivotal role in detecting early stress signals through the utilization of advanced machine learning capabilities.

Harnessing the capabilities of AI, the system unearths latent patterns within customer behavior, thereby shifting manual monitoring from a retrospective approach to a proactive stance in risk management.

Related

Products

You might also be interested in our other lending solutions

Debt

Collection

offers a debt management, collection and recovery solution. Maximises operational efficiency, reduces the cost to collect and ensures the delivery of excellent customer services.