Debt

Collection System

In the realm of loan management, handling non-performing loans requires a proactive approach and robust strategies. With ApPello Debt Collection Solution, financial institutions can effectively manage non-performing loans right from the first warning signs. This comprehensive system offers different workflows to prevent or handle workouts, supporting both soft and hard collection strategies..

ApPello Debt Collection Solution empowers financial institutions to manage their entire workout portfolio seamlessly, from the initial phone call to the closure and legal processes. By utilizing a single, well-balanced application, institutions can streamline their debt collection operations and optimize their chances of successful resolution.

Discover

Product Details

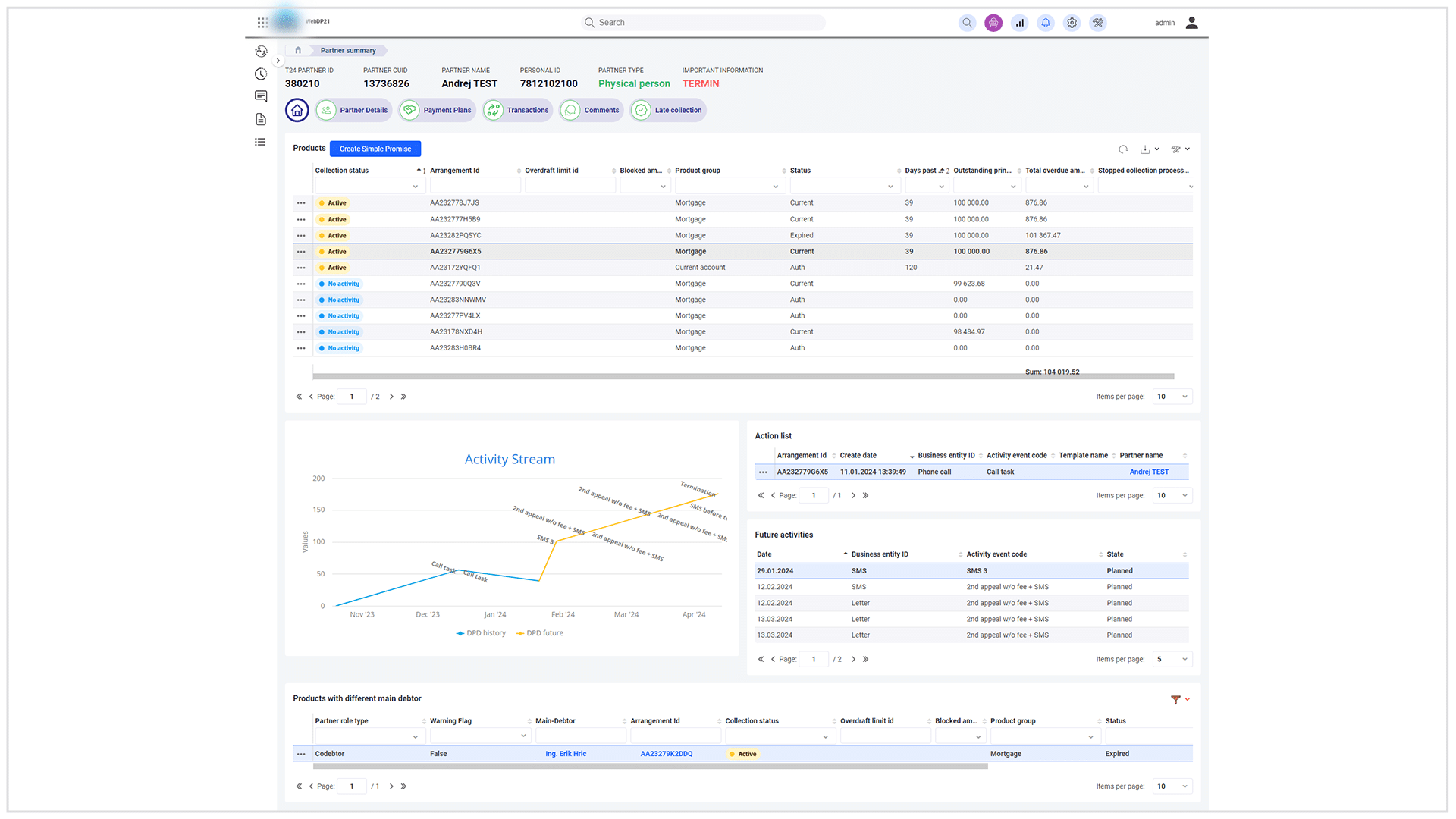

In today’s dynamic business environment, having the ability to segment clients, recognize patterns of client behavior, and respond swiftly is crucial for effective debt collection. The solution provided by ApPello offers a comprehensive suite of collection-related options and tools, enabling businesses to optimize their collection strategies and adapt to changing circumstances promptly.

The Debt Collection Module provided by ApPello offers extensive support for both soft and hard collection strategies, covering all phases of the collection process, from early intervention to late-stage recovery, including the legal phase. With a range of features and functionalities, the module facilitates efficient communication with clients, streamlines proposal handling, enables pay-off management, and provides valuable portfolio analysis capabilities.

Benefits

Comprehensive solution for early/late collection support

Automatic

client segmentation

Configurable collection strategies & workflows

Easy & quick promise

to pay recordings

Advanced built-in template management, Transparent external actor management

Complete SLA, pay-off & portfolio analysis

Flow of

Debt Collection Process

Initializing

- Batch or online integration

with Credit Bureau Services - Standard, predefined API’s

- Automated segmentation

Collection strategy

- Strategy builder

- Unique strategies, configured

by admin users - Process mapping and improvement without coding

Document management

- Built-in document

template editor - Configurable text messages,

e-mails and letters

Decision strategy

- Decision Workflows, both for soft and hard collection processes

- Proposals preparation

- Dynamic and custom processes

Loan settlement

- Settlements monitoring

- Automatic generation repayment contracts

- Transparent Promise To Pay (PTP) monitoring

Monitoring

- SLA, pay-off & portfolio analysis

- Improved EOD processes

Process follow-up

- Quick and effective

business process follow-up - Time saving and efficient reporting and analysis

Wide range of

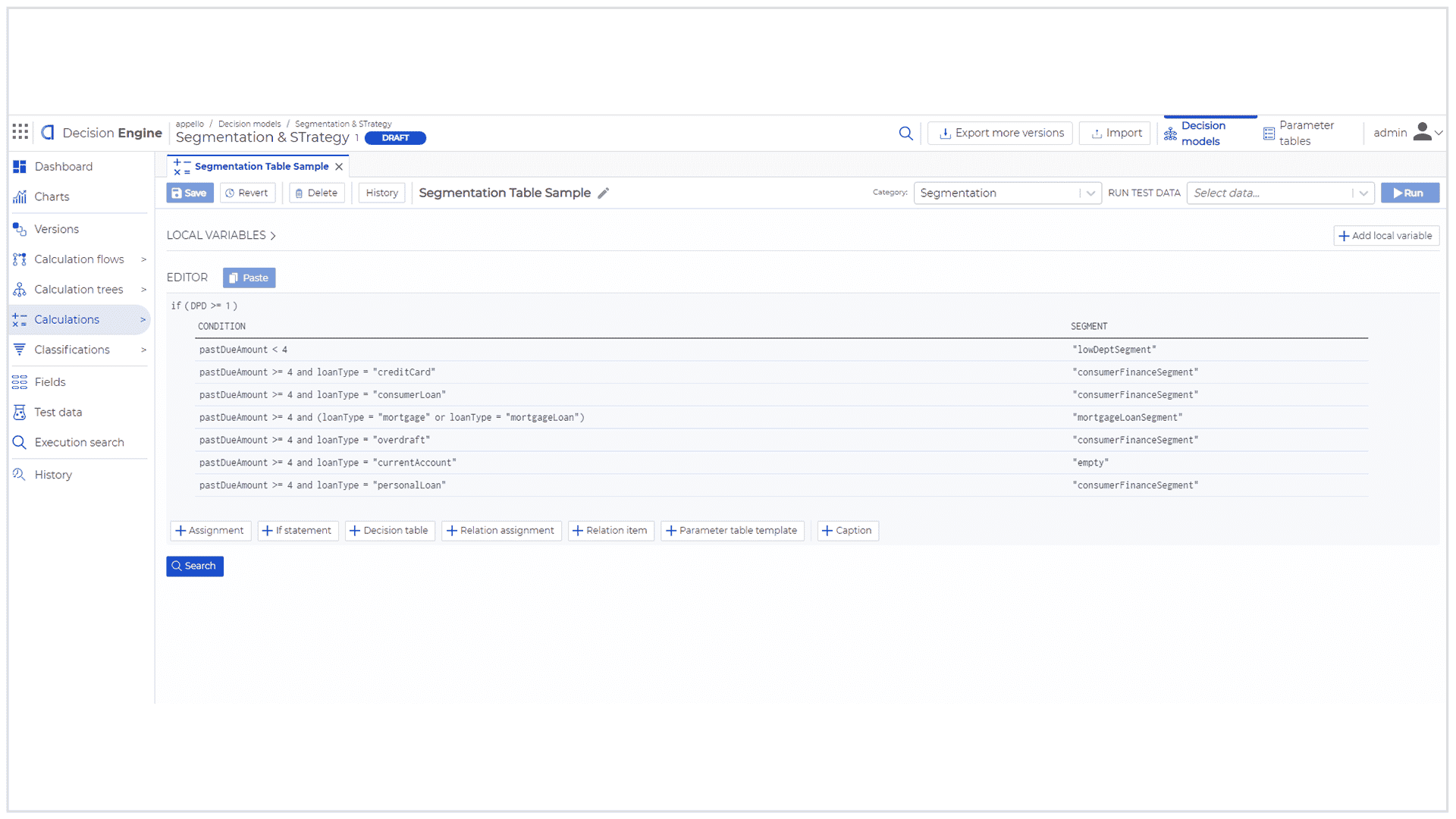

Segmentation options

ApPello’s debt collection solution offers a wide range of segmentation options to enhance the management of outstanding non-performing loans. Through automatic segmentation and the assignment of collection strategies, businesses can streamline their debt collection processes effectively. This is achieved through the utilization of flexibly adjustable business rules, driven by a built-in rule engine and conditions defined by power users.

Flexibly configurable

collection strategies

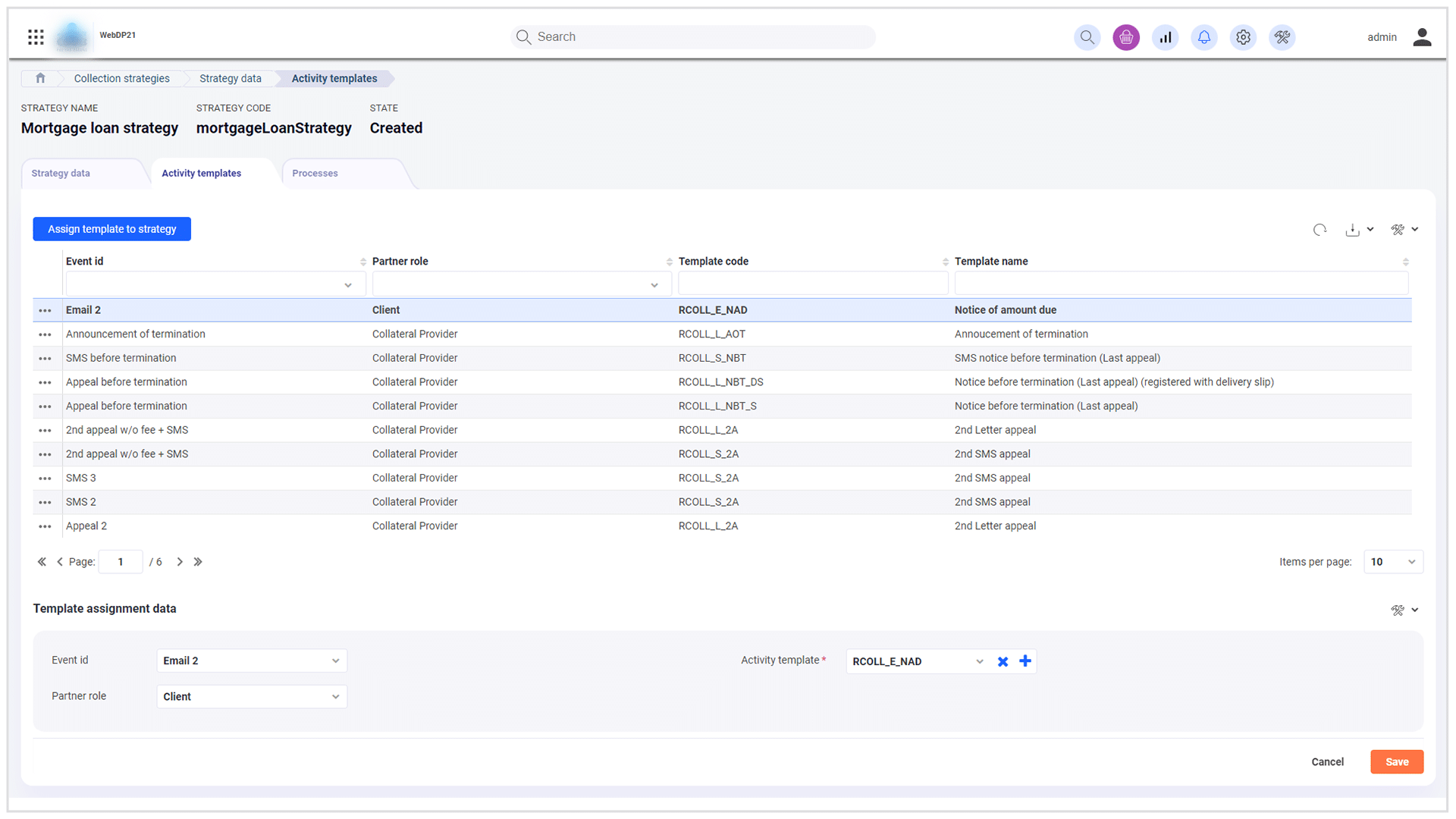

Automatically assigned collection strategies encompass the planned activities governing collection processes, which rely on adaptable workflows and task management capabilities.

The role-based workflow incorporates various internal departments and external entities. Power users possess the ability to alter existing strategies and generate new ones.

In the case of challenging collection processes, the system offers a workflow editor that empowers power users to effortlessly configure any such processes within a matter of minutes, or even devise entirely new workflows. This flexibility allows the bank to promptly adjust to the ever-evolving financial and regulatory landscape.

Soft Collection

Support

The tool offers a comprehensive range of capabilities via strategy-based workflows. The system facilitates the automated generation of notifications, including emails, text messages, and letters, based on different collection strategies using configurable templates. It also enables the registration of payment promises and payment plans with customizable templates, along with providing ad-hoc messaging options.

The Solution can seamlessly integrate with any pre-existing interface, such as Call Center software or a document management system. All client-facing communications, including bulk messaging, can be edited and managed within the Debt Collection System, which features a fully-fledged document template editor, ensuring complete control over the communication process.

Hard Collection

Support

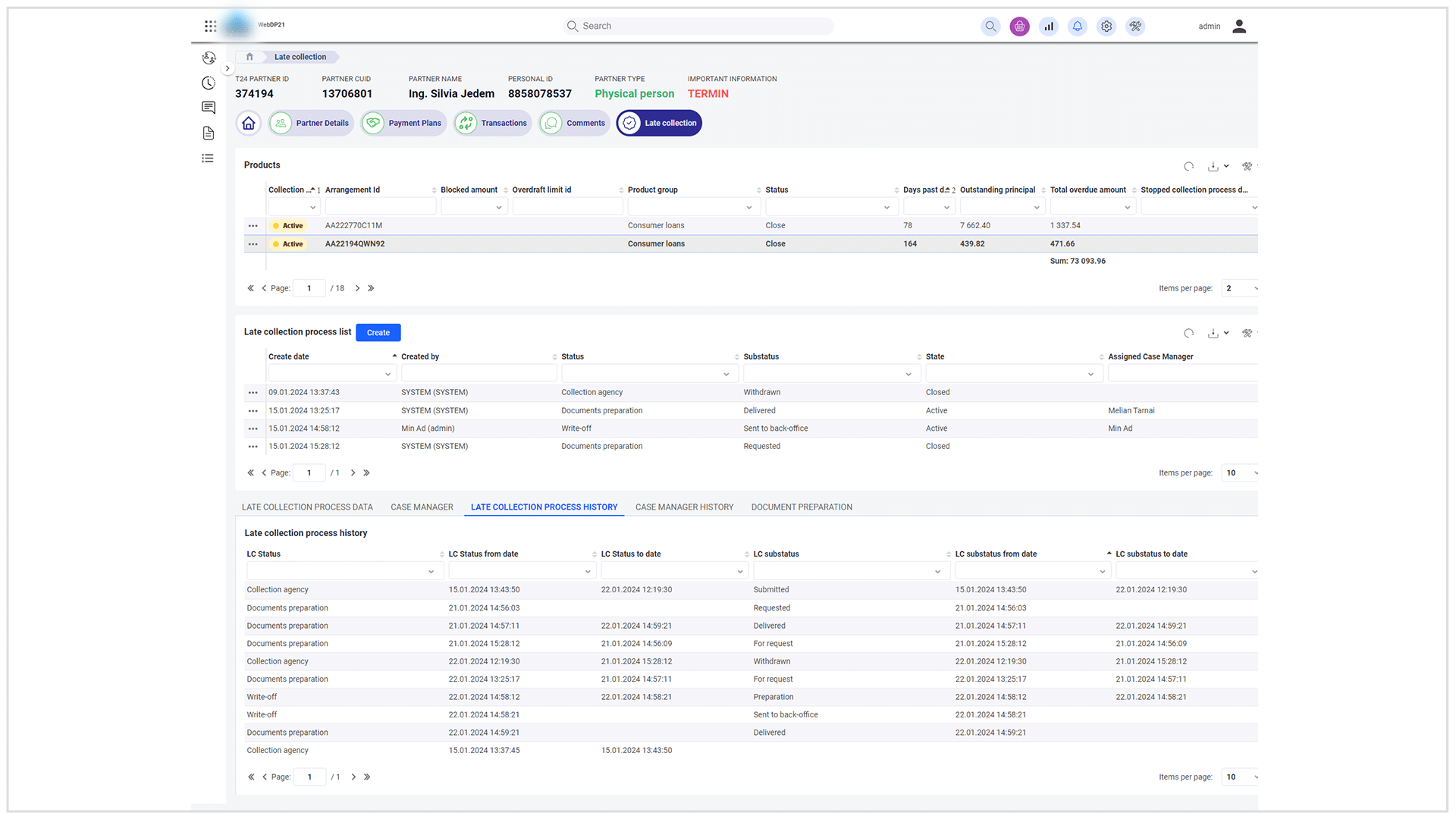

Introducing our Hard Collection Solution, a powerful tool that transforms the intricate landscape of late collection processes. To enhance efficiency, our platform integrates the Camunda BPMN, ensuring adaptability during hard collections, with each process featuring multiple workflows and treatments.

Seamlessly manage external partners, including collection agencies and solicitor offices, through standardized communication and an audit trail feature.

To streamline data management, our solution boasts a mass upload functionality. This feature empowers users to create or modify a substantial amount of data through template-based mass import.

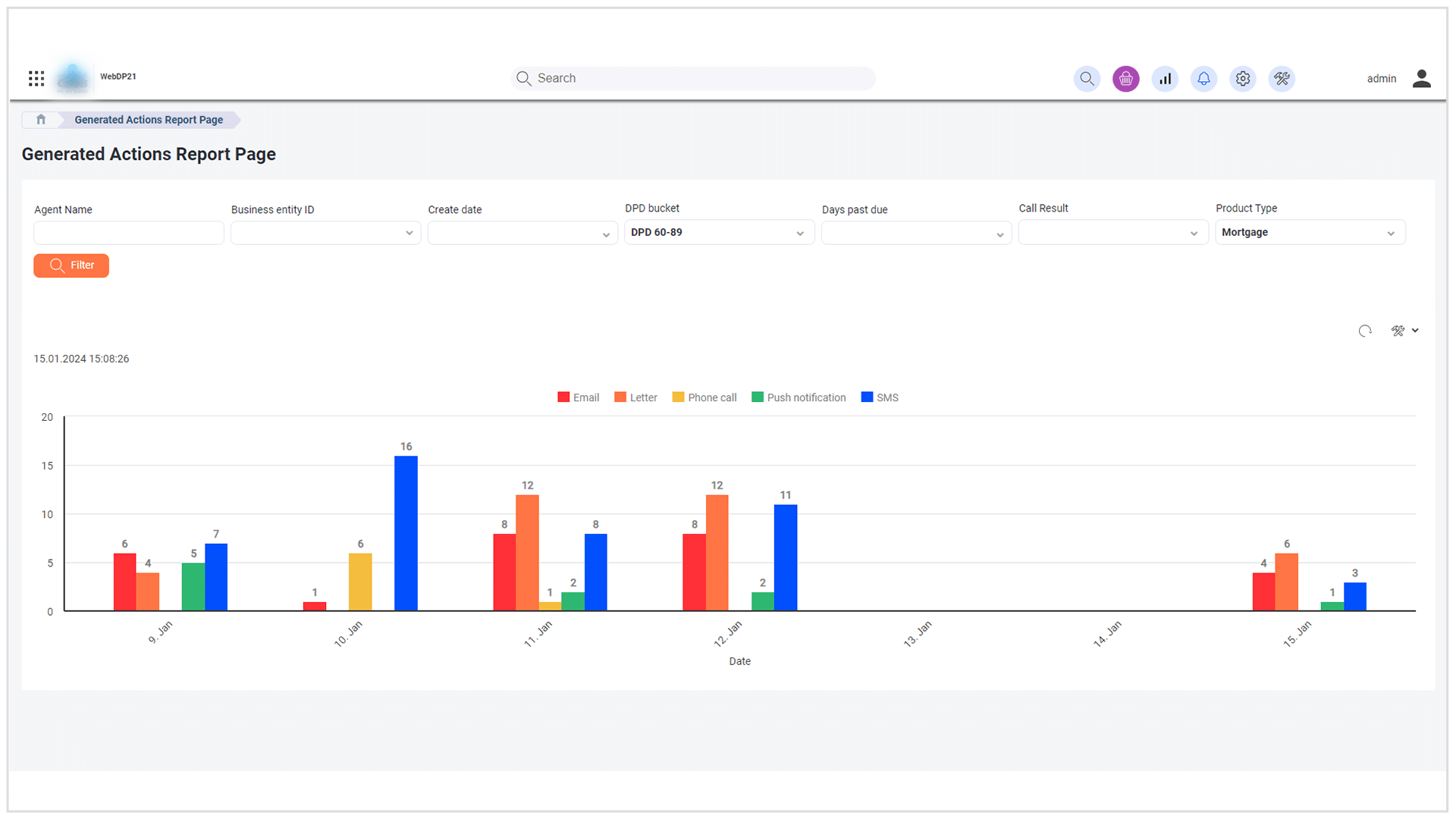

Reporting

with less time and effort

The reporting functions within the Collection Solution play a vital role in enabling decision-makers to effectively monitor and supervise the collection strategy while obtaining comprehensive information about the entire portfolio at any given time. The system offers user-friendly graphical tools, allowing for the easy creation of charts, as well as configurable, searchable, and filterable list screens that can be exported to formats such as Excel, CSV, or PDF. This flexibility extends to all types of lists, charts, and custom reports, ensuring a wide range of reporting options.

ApPello’s Collection Solution includes a robust SLA measurement module that enhances transparency for every task. Power users have the ability to define standard execution times for each task, which can be parameterized either through Excel import files or within the application itself using a graphical interface. The configurable summary screens empower supervisors to access task-related data, facilitating the optimization of daily processes and the overall improvement of the department’s performance.

Related

Products

You might also be interested in our other lending solutions!

Early Warning &

Monitoring

module is responsible for checking the terms & conditions of contracting and disbursement among others and for early identification of future non-

performance.