Corporate & SME

Loan Origination System

Efficiently processing and evaluating loan applications and clients requires both speed and thoroughness. However, achieving this without purpose-built tools can prove challenging. Utilizing specialized tools for commercial lending not only enables fast and comprehensive processing but also facilitates measuring the effectiveness of the entire process. Our solution goes beyond conventional processing by incorporating ESG considerations into the heart of the system.

Discover

Product Details

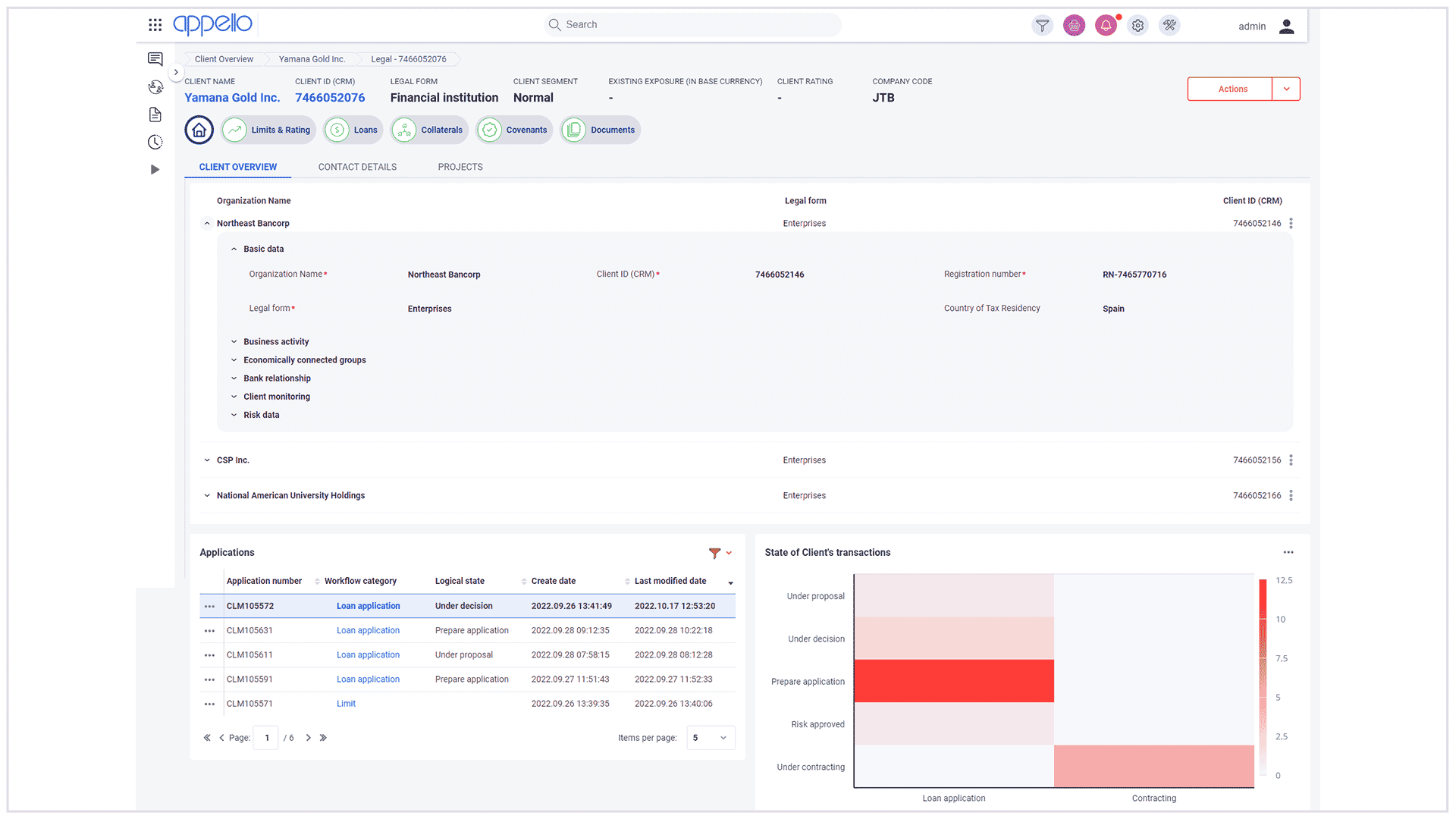

ApPello Corporate & SME Loan Origination offers a comprehensive end-to-end solution with user-friendly features, specifically tailored to streamline commercial lending. This powerful platform effortlessly manages the intricacies of complex products and diverse company structures.

Given that corporate loan origination typically involves multiple departments and extends over time, it is vital to maximize efficiency.

To achieve this, process management tools play a pivotal role in seamlessly handling recurring and parallel processes, ensuring smooth operations throughout the entire journey.

The Loan Origination System is a technologically crafted innovative tool, based on our modern, low-code microservices platform.

Benefits

Cost reduction with optimised processes, flexible toolset, changeable rules, screens, dataset, workflow

Shorten origination processes through the use of automation, document management and integration

Improved sales effectiveness with omnichannel capabilities and enhanced customer experience

Risk reduction with an implemented Decision Engine

Prompt reaction to market needs with easy configuration and easy to adjust credit policies & business rules

ESG data collection and evaluation

End-to-End

support of LOS

ApPello’s Loan Origination System provides comprehensive coverage of the lending process, starting from the initial interaction with prospects and extending throughout the entire credit lifecycle. This encompasses monitoring, change management, and maintenance processes, all supported by the standard Camunda BPMN within ApPello’s platform.

This integrated solution seamlessly combines loan origination, credit workflow processes, and the management of loan and collateral administration. Successfully implemented in diverse banking environments, the modular nature of the solution ensures flexibility and adaptability.

The application incorporates a complete commercial lending and pricing workflow, accompanied by distinct front-end interfaces tailored for various application purposes.

Workflow of Corporate Loan Origination

Client Acquisition

- Credential and contact information management

Loan Application

- Online loan application and self-service portal

- Pre-screening

- Loan purpose identification

- Product selection

- Documents upload

Origination

- Indicative offer to client

- Cross-sell (multiple loan agreement)

- Covenant management

- Initial repayment plan

Scoring/Rating

- PD, Rating, LGD, Limit, Pricing calculation

- Risk-based pricing

- AML, Fraud, Credit bureau, TAX database

- AI, Machine learning

- Credit limit calculation

Underwriting

- Risk assessment (policies, limits, triggers)

- Final scoring / rating

- Decision administration

- Decision monitoring

- Overrule, escalation processes

- Contra-offer (incl. upsale)

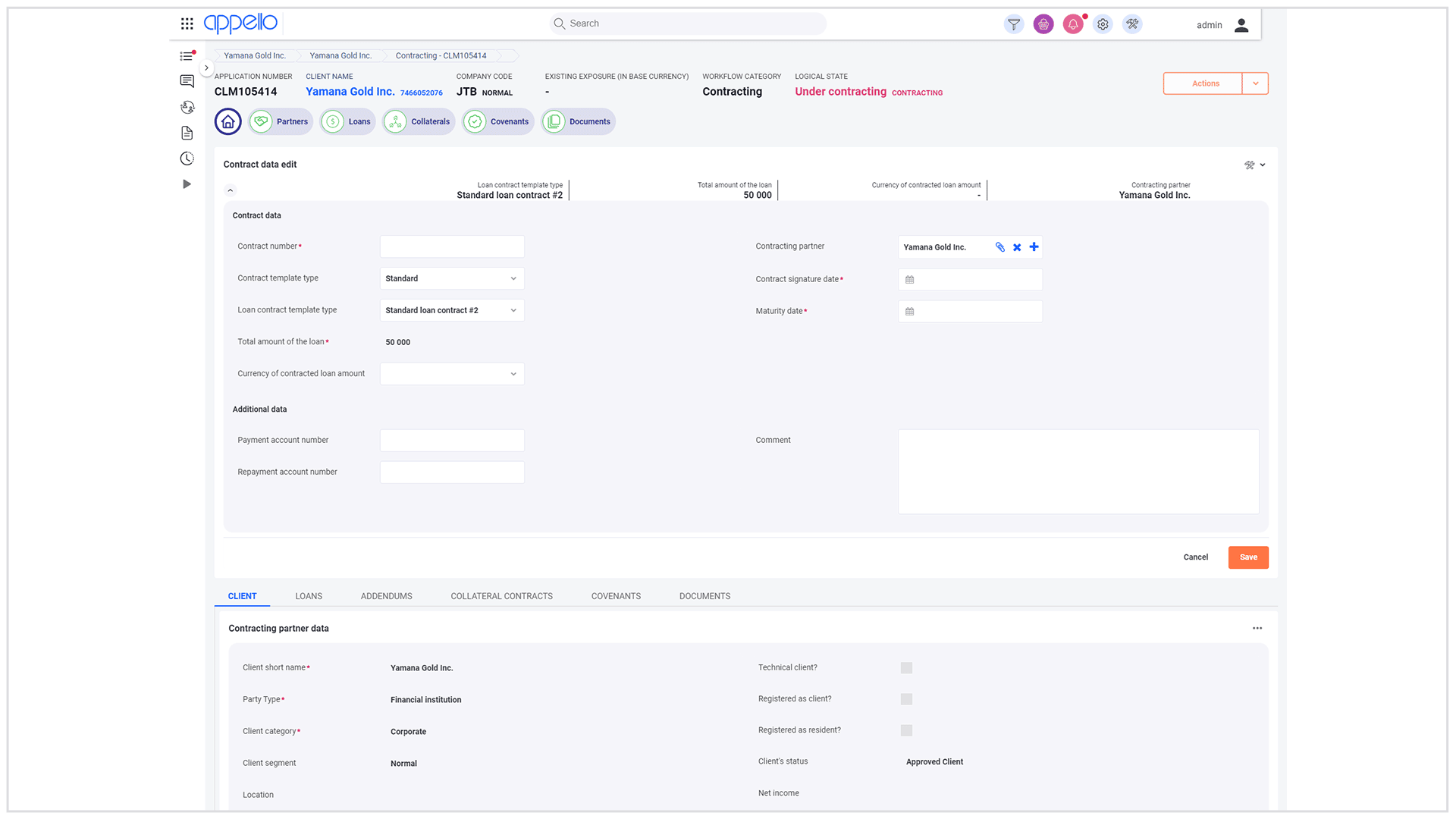

Contracting

- Check conditions

- Document checklist

- Contract generation

- Signature process

Disbursement

- Check disbursement conditions

- Record disbursement in core system

Monitoring

- Disbursement monitoring

- Covenant monitoring

After care

- Waivers

- Prolongation

- Restructuring

- Termination

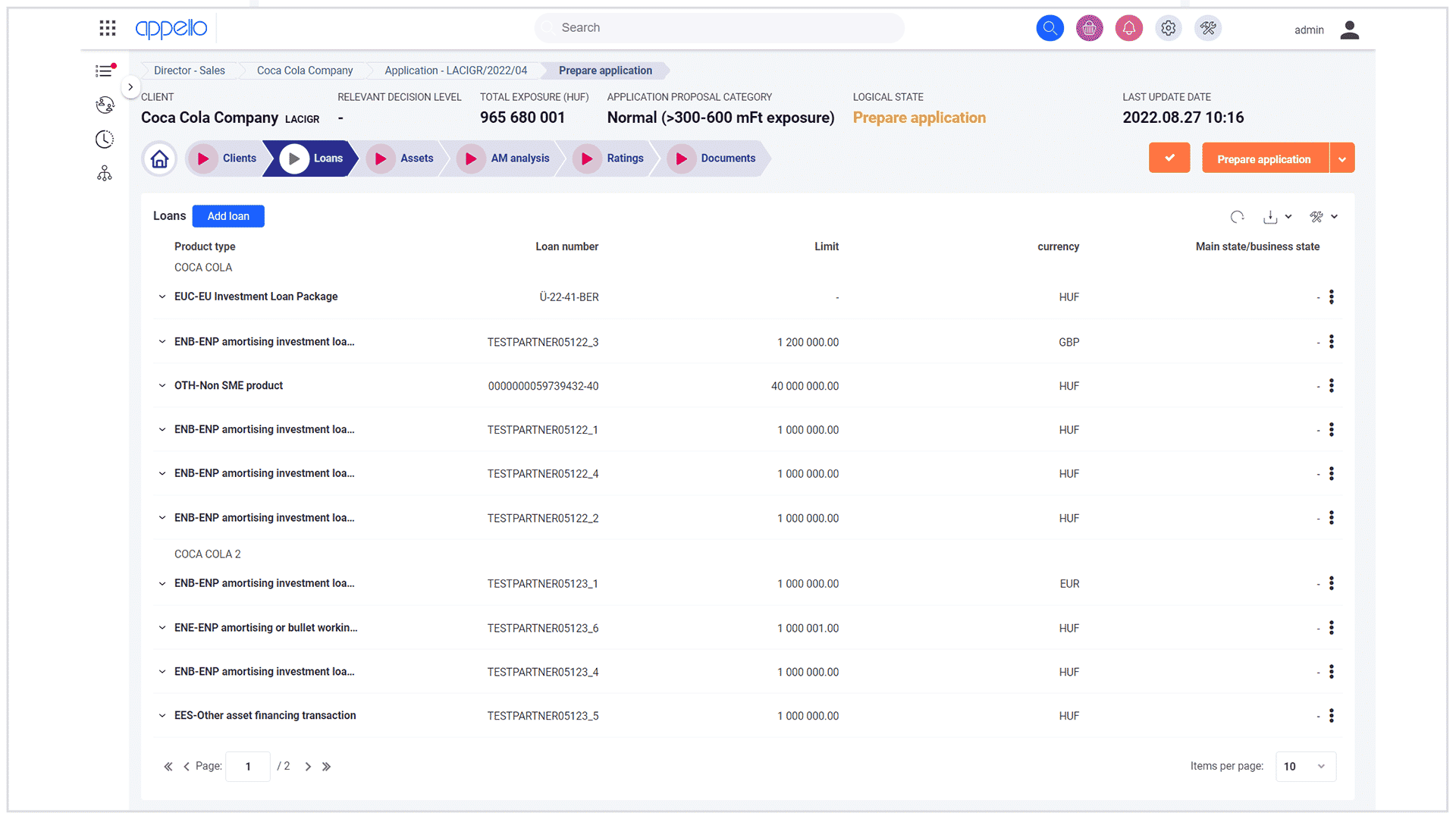

Supported

Loans

ApPello Digital Loan Origination System can handle the commercial lending in micro, SME, large corporate segments including the following loan types:

- Business loans

- Investment loans

- Overdrafts

- Revolving loans

- Short-term loans

- Operating loans

- Loans for purchase (interest or share)

- Refinancing loans

Improved sales effectiveness

and customer satisfaction

ApPello’s Loan Origination System combines both front- and back-office functionalities in an integrated manner. With its streamlined customer experience, it effectively accelerates the credit application process. The system’s development has been centered around reducing the time-to-decision for in-house users and the time-to-money for bank clients, prioritizing efficiency and speed throughout the entire lending journey.

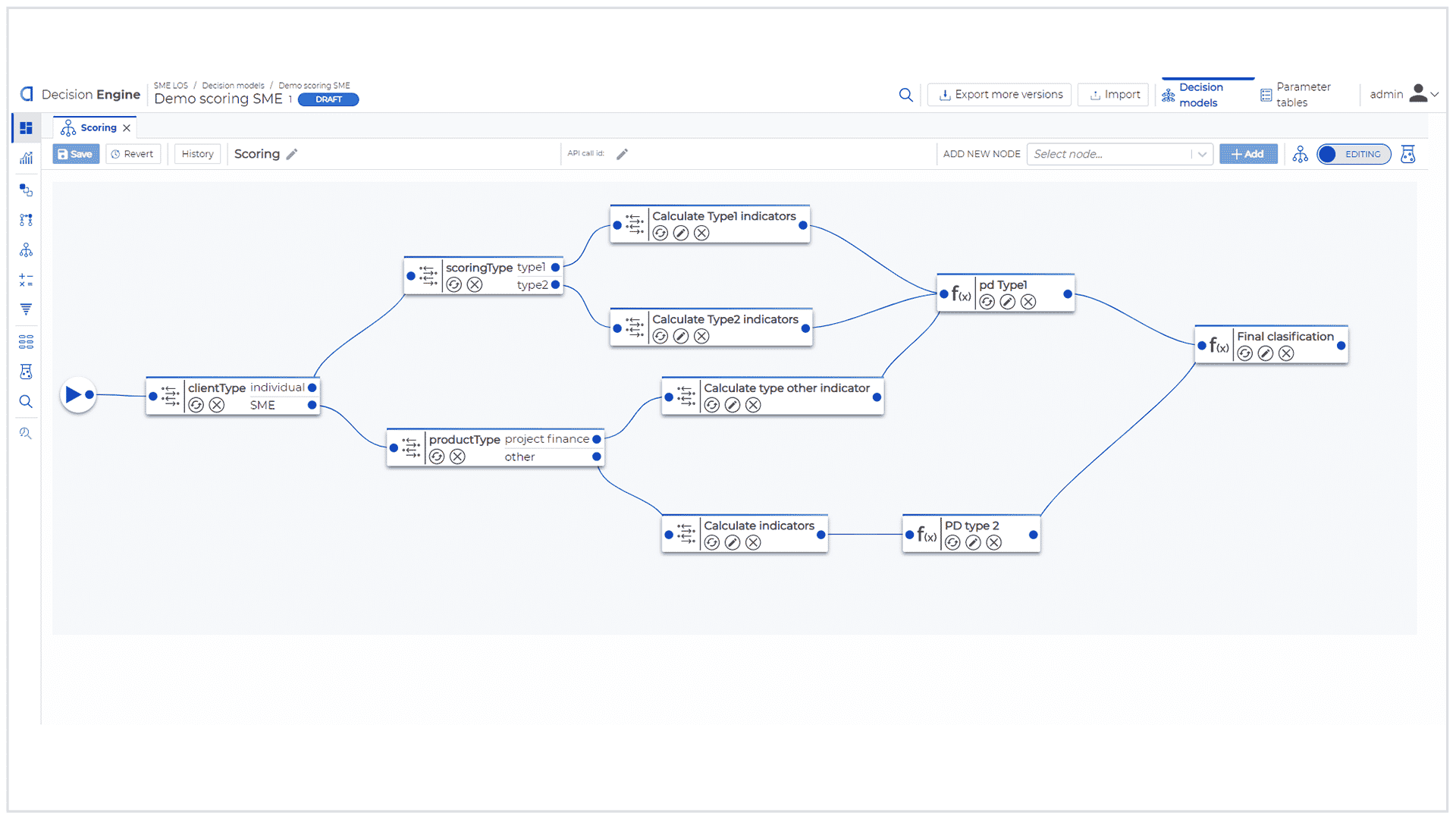

Decision

Engine

The Decision Engine is seamlessly integrated into the Loan Origination System via its APIs, ensuring smooth and efficient operation.

This powerful engine performs a range of functions, including pre-screening, classical scoring, rating, limit calculation, and additional decision points. It possesses the capability to handle an unlimited number of distinct decision logics, allowing for differentiation based on customer segments (including sub-segments), products, and product variants.

Furthermore, the engine accommodates the creation and customization of business rules and decision logic, aided by graphical visualization. Bank employees with relevant roles can build and modify these rules without the need for extensive IT expertise, empowering them to make efficient and tailored decisions.

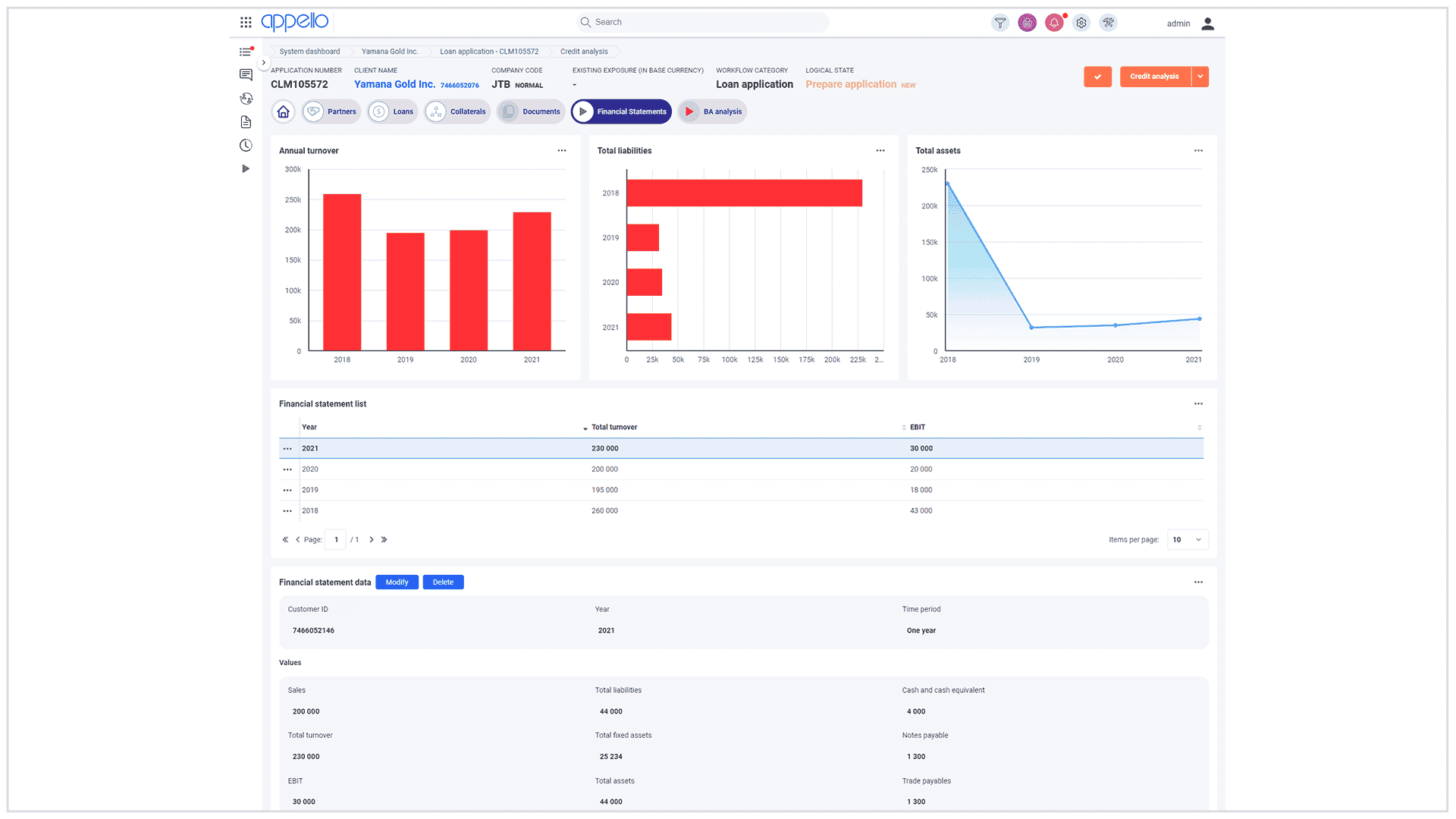

Financial statement

Analyser

Financial Statement Analyser component is designed to streamline credit risk management by providing a comprehensive suite of features for the centralized collection and analysis of financial statement data. Whether you adhere to IFRS, local GAAPs, or other accounting standards, our analyzer seamlessly accommodates them all.

The Financial Statement Analyser operates as a seamlessly integrated module within your Loan Origination System. This integration ensures a smooth and hassle-free experience, allowing you to focus on what matters most – making informed credit decisions.

Key Features for Unmatched Performance:

Accurate Financial Ratios and Cash Flow Analysis:

Unlock the power of precise financial ratios and cash flow calculations to gain deeper insights into the financial health of your clients. Our analyzer utilizes sophisticated algorithms to provide you with meaningful metrics that help identify potential risks.

Cross-Standard Conversion Made Easy:

Converting financial data from different accounting standards into a unified and comparable format has never been easier. Our Analyser efficiently harmonizes data, enabling you to make direct comparisons and uncover crucial patterns effortlessly.

Future Period Projections: Stay ahead of the curve with our advanced projection capabilities. Anticipate future trends and potential financial challenges with confidence, empowering you to proactively manage risks and seize opportunities.

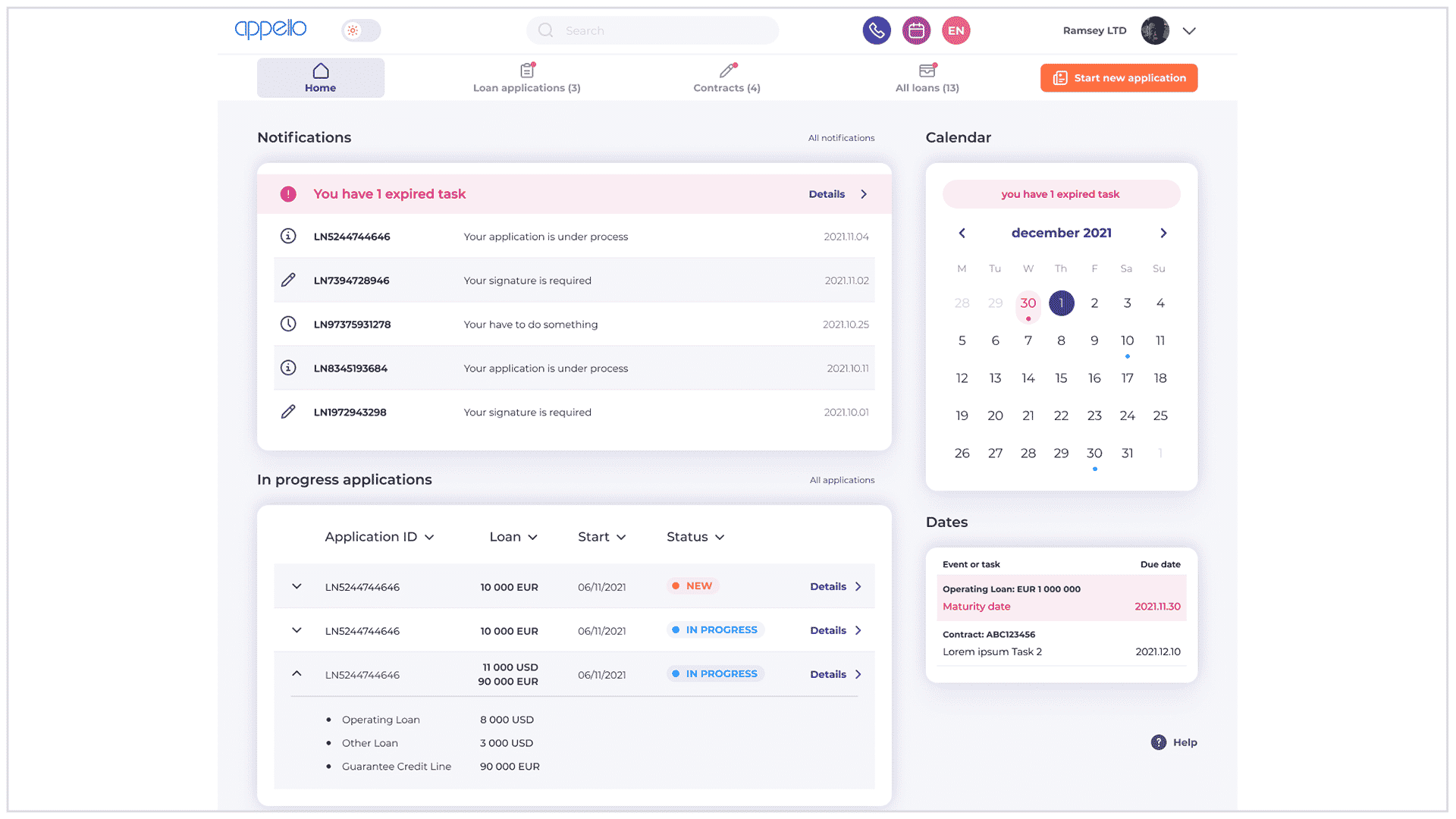

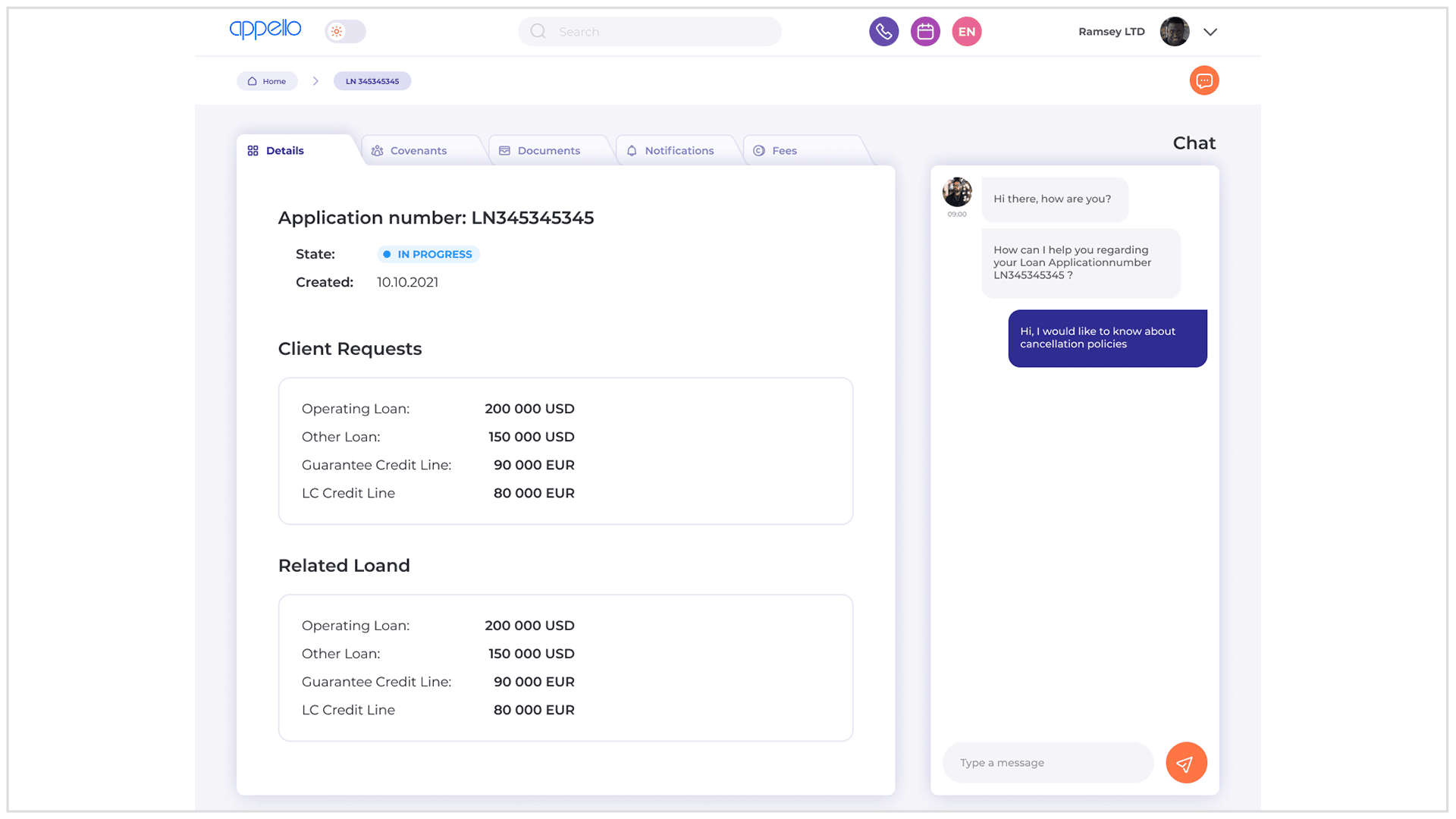

Transparent and smooth

customer journey

With ApPello Loan Origination System, we revolutionize the way banks interact with their customers through a cutting-edge self-service portal. Designed with modern and user-friendly functions, our portal sets the standard for superior customer experience, empowering your institution to stay ahead in today’s competitive market.

Efficiency Redefined: Say goodbye to traditional methods and embrace efficiency like never before. ApPello LOS self-service portal streamlines processes, reducing costs for your bank while elevating customer satisfaction to new heights.

Customer Attraction and Retention: Attracting new customers and retaining existing ones becomes effortless with our self-service portal. Deliver an exceptional customer experience, and watch as your bank’s reputation soars, capturing the loyalty of clients for the long term.

Empowering Communication: ApPello LOS bridges the gap between your bank and its customers. Our portal facilitates seamless communication, enabling clients to interact with your institution with ease. From inquiries to updates, your customers can stay informed and engaged every step of the way.

Convenience in Document Management: Document submission made simple. ApPello LOS empowers customers to conveniently upload required documents, eliminating paperwork hurdles and reducing processing times. Streamlining document management has never been easier.

Real-Time Loan Status Updates: Keep your customers in the loop with real-time loan status updates. ApPello LOS empowers your clients to track progress effortlessly, ensuring transparency and building trust.

Tailored Loan Purposes: ApPello LOS puts you in control of your loan origination backend. Customize and maintain a wide array of loan purposes to cater to diverse customer needs. Personalization is the key to meeting your clients’ unique requirements effectively.

Seamless Integration: We understand the importance of seamless integration with your existing systems. ApPello LOS smoothly integrates into your operations, minimizing disruption while maximizing efficiency.

Security and Reliability: We prioritize the security and confidentiality of your data. ApPello LOS implements robust measures to protect your sensitive information, ensuring a reliable and trusted platform for both your bank and customers.

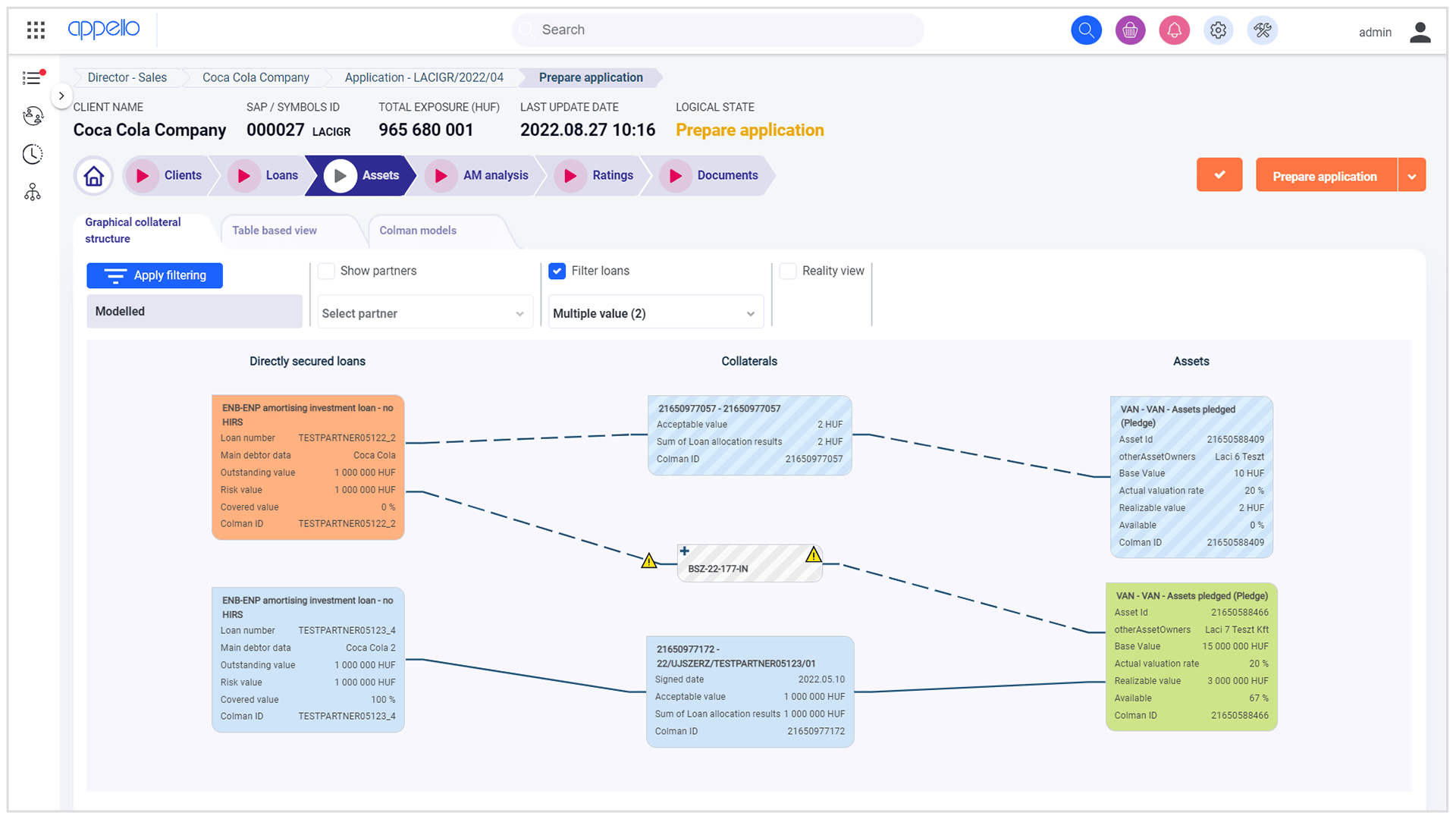

Managing

Collaterals

In the loan origination process, having a comprehensive view of existing loans and collaterals is crucial. Our System simplifies this task by enabling easy entry of obligations and collateral data through a user-friendly interface. Additionally, you can effortlessly import data using standard APIs, further enhancing efficiency. Need to include supplementary data? No problem! Our system allows seamless entry for any selected collateral.

Key Features:

- Hassle-free Collateral Input: Enter obligations and collateral data effortlessly using our intuitive screen interface, ensuring accuracy and speed in the loan origination process.

- Seamless Data Import: Save time and effort by importing data via standard APIs, allowing for quick integration and minimizing manual data entry.

Supplemental Data Flexibility: Customize your collateral records by adding supplementary data as needed, providing a comprehensive view for better decision-making.

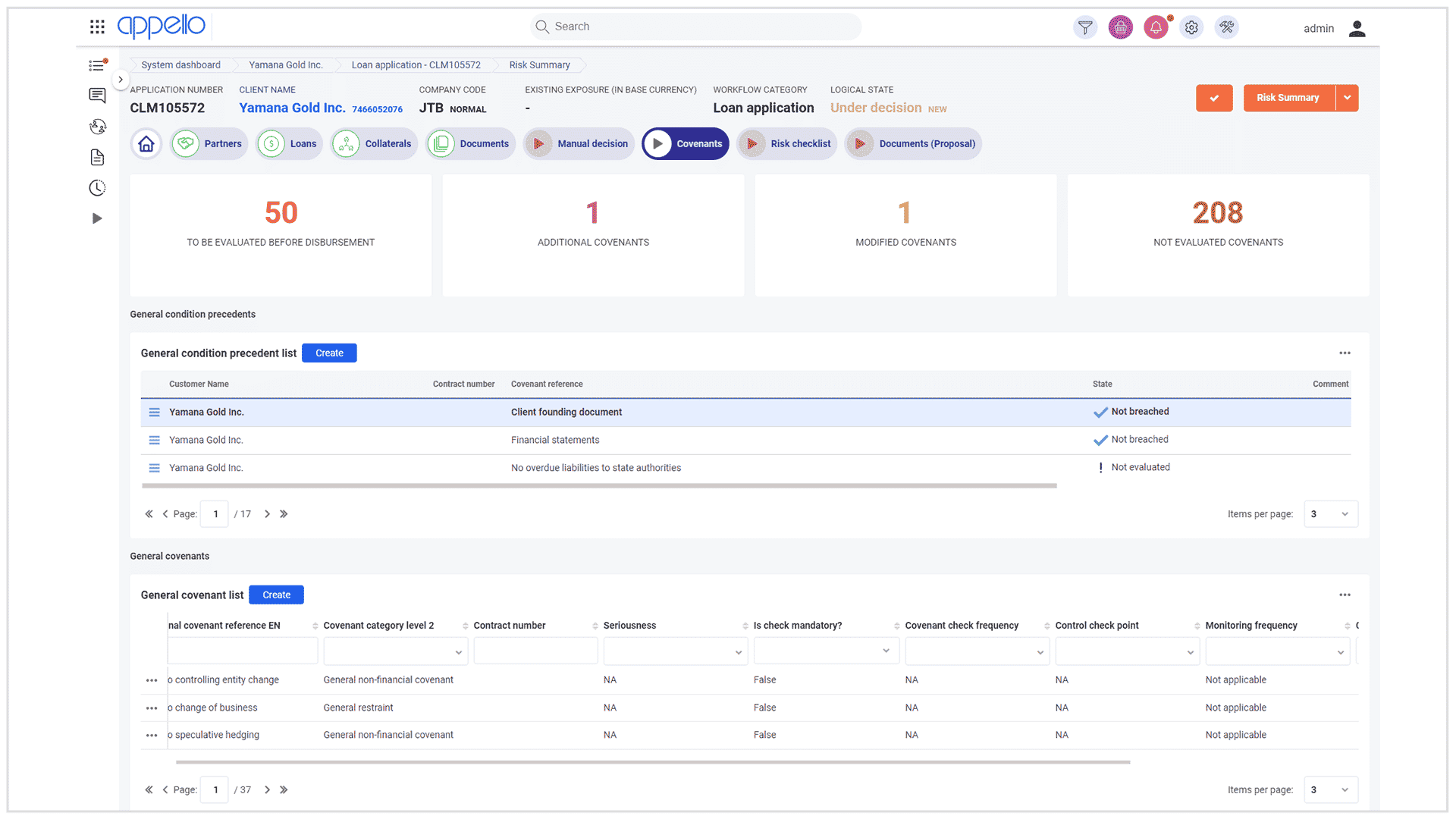

Managing

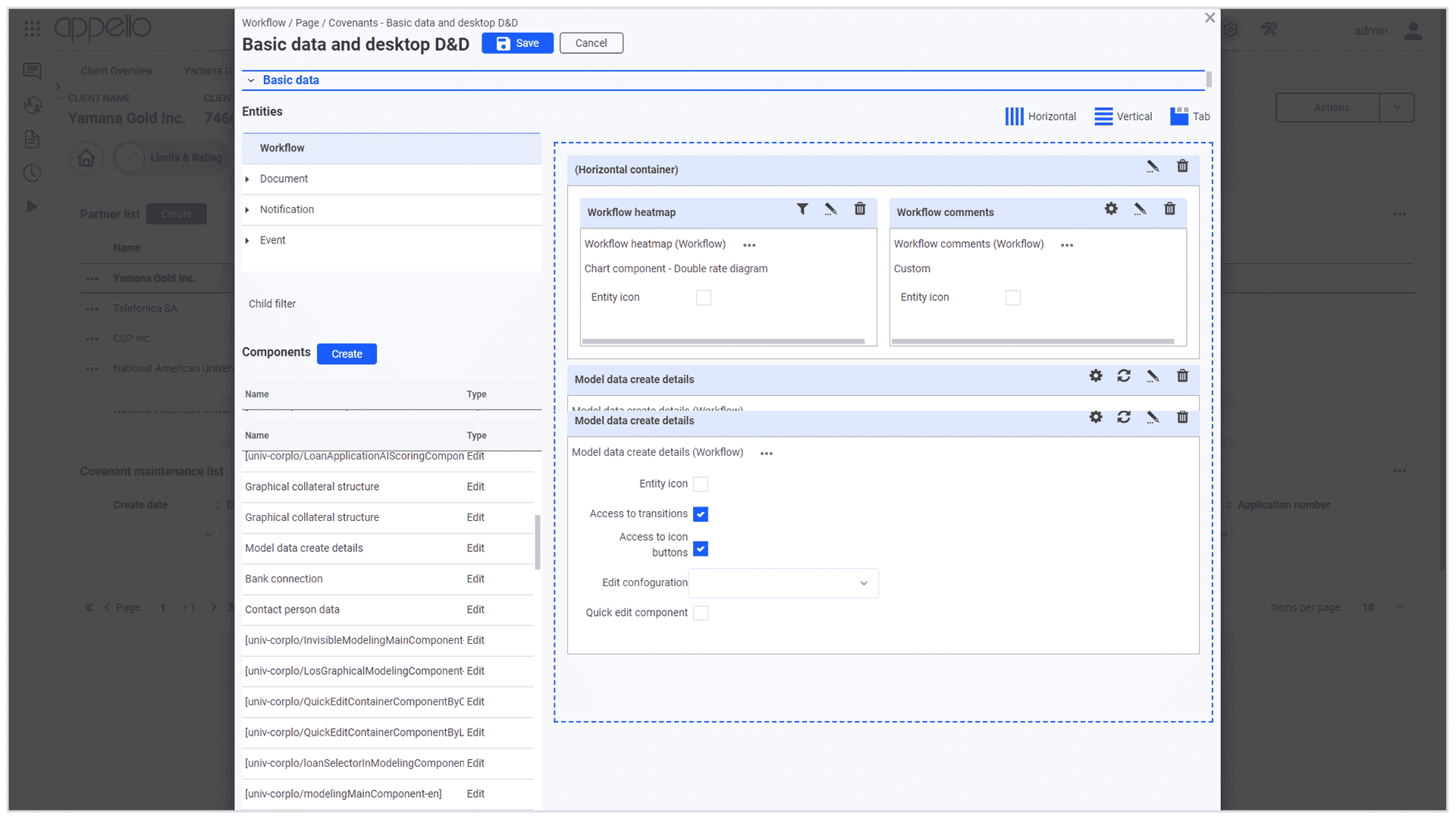

Covenants

Our system effortlessly handles diverse financial and non-financial conditions. Covenants are intelligently connected to loans, partners, and workflows, each belonging to a specific covenant type.

Experience Automated Covenant Generation:

With our system’s intelligent covenant definitions, the loan origination process becomes a breeze. The system automatically generates appropriate covenants based on defined parameters, ensuring accuracy and efficiency.

Customize with Ease:

We value flexibility. Relevant users have the power to add unique covenants during the loan origination process, tailoring the covenants to specific needs and requirements.

Key Features:

Seamless Covenant Association: Connect covenants to loans, partners, and workflows for seamless tracking and management.

Streamlined Covenant Types: Categorize covenants efficiently under covenant types for easy organization and reference.

Automated Covenant Generation: Save time and reduce manual effort with the system’s automatic covenant generation feature.

User-Driven Customization: Empower relevant users to add unique covenants, enabling personalized loan management.

Documents &

Contracts

Our integrated document management solution is a powerful tool designed to streamline your document generation and storage processes. This innovative module is specifically tailored to handle any type of contract, ensuring efficient and accurate document creation every time.

The system automatically gathers all necessary information and fills in every detail. This is made possible through the utilization of MS Word templates featuring macros, providing a seamless and standardized approach to document creation.

Through the use of document management tools, our solution allows you to effortlessly generate a wide range of documents based on templates, which are then automatically populated with all relevant and available data within the system. This significantly reduces manual effort and saves valuable time, particularly during the loan origination process.

Our platform is invaluable in preparing all paperwork required for the loan origination process, encompassing loan proposals, contracts, notifications, statements, and more. This comprehensive support ensures a hassle-free and efficient process from start to finish.

Additionally, our solution boasts digital signature support, enabling the verification of contracts and agreements with ease and security. This feature further enhances the credibility and legality of your documents, instilling confidence in your business transactions.

Corporate risk management

with groups of connected clients

In the corporate sector, it is a common practice to process applications by first scoring the risk group of the client and then assessing the existing and proposed exposure levels for this group. To manage the complexities associated with SME & Corporate lending effectively, financial institutions can efficiently handle Groups of Connected Clients (GCC) at a group level.

By utilizing this approach, financial institutions gain a strategic advantage in managing lending complexities. The GCC framework allows for a more comprehensive evaluation of risk, as it considers the collective exposure of interconnected clients within a group. This enables a more accurate assessment of potential risks and benefits when dealing with multiple clients who are interconnected through various business relationships.

Embracing

ESG Principles

System is enhanced by ESG-related information such as physical risk, physical risk details, location, energy performance, energy consumption, heating source type, etc… With this data, Banks are able to start the assessment of each loan application, incorporate the ESG-related information in their lending strategy, and understand the physical risks in terms of finance. Besides, Banks are able to introduce preventative measures that could help to mitigate certain risks.

Configuration

over customization

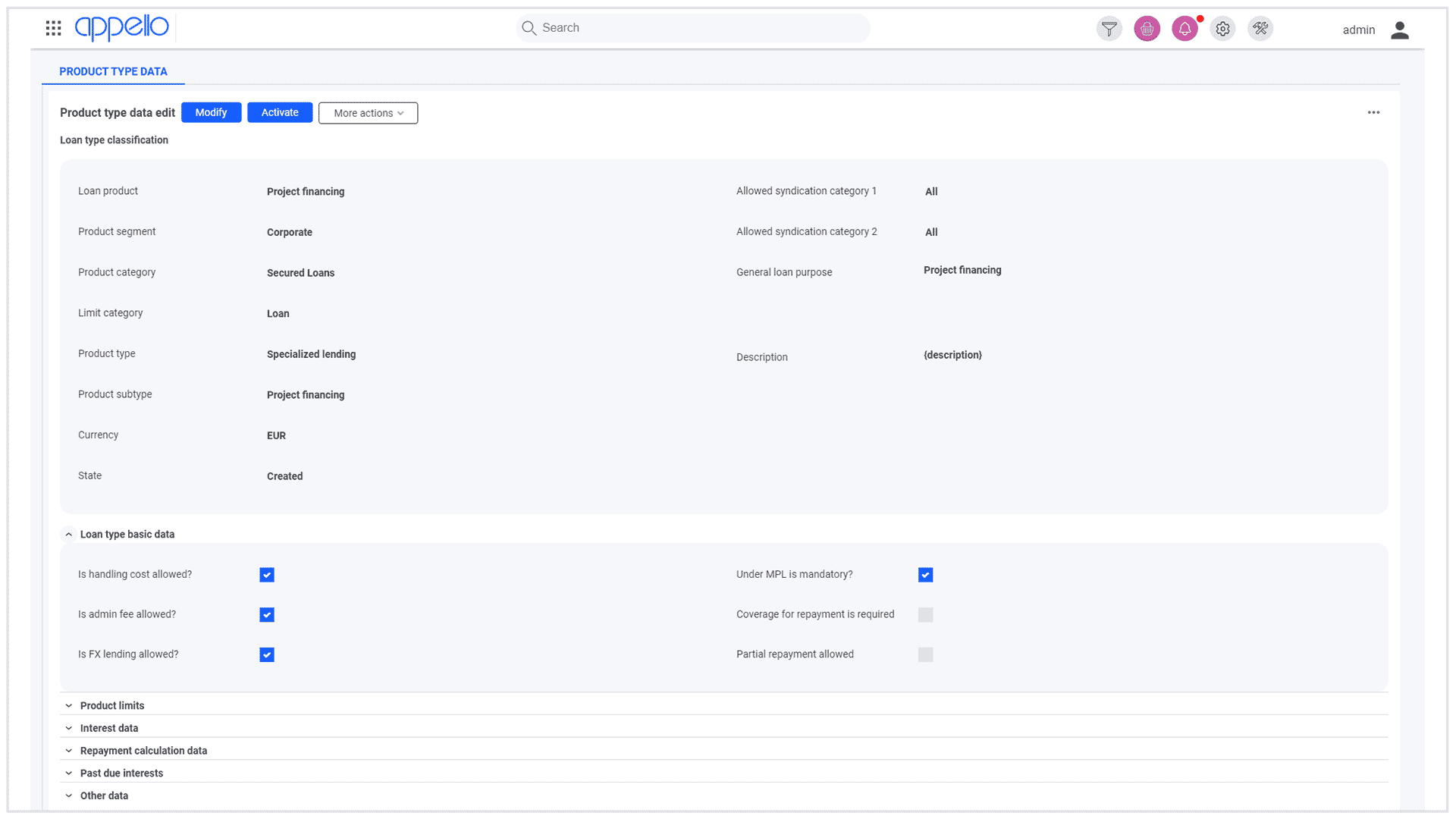

ApPello Corporate and SME Loan Origination System empowers banks to create diverse workflows using different workflow steps without relying on ApPello or an IT team for assistance. This flexibility enables institutions to adapt and optimize their processes according to evolving business requirements without any delays or technical hurdles.

Notably, the precondition and completion criteria for all workflows can be easily parameterized, ensuring a smooth and dynamic workflow execution. Our platform accommodates a range of parameters, allowing banks to tailor workflows to meet various scenarios and business conditions.

Business

Configuration

In addition to handling business calculations, the system offers the flexibility to manage its business parameters through Excel.

The system features a comprehensive set of Excel import functions (10+) designed to facilitate the maintenance of standard parameter rulesets in Excel format, ensuring they can be easily audited and validated. The key catalogs that are regularly utilized encompass:

- Product catalogue

- Collateral catalogue

- Covenant catalogue

- Document type catalogue

ApPello Case Studies

Corporate Loan Origination System Implementation

András Tóth, our Head of Business Analyst summarized his thoughts and feelings after a long, very intensive, and interesting Corporate Loan Origination Project.

The Imperative of Corporate Loan Origination System

Insights from Béla Vér, CEO at ApPello

Related

Products

You might also be interested in our other lending solutions

Unsecured Retail

Loan Origination

ApPello Loan Origination System is designed for banks and financial institutions to manage the lending processes of unsecured retail loans.

Decision

Engine

Speeds up and automates decisions. It is a segment and product-independent solution that can handle business-related decisions of varying complexity within a centralised platform.