Core Banking

Engine

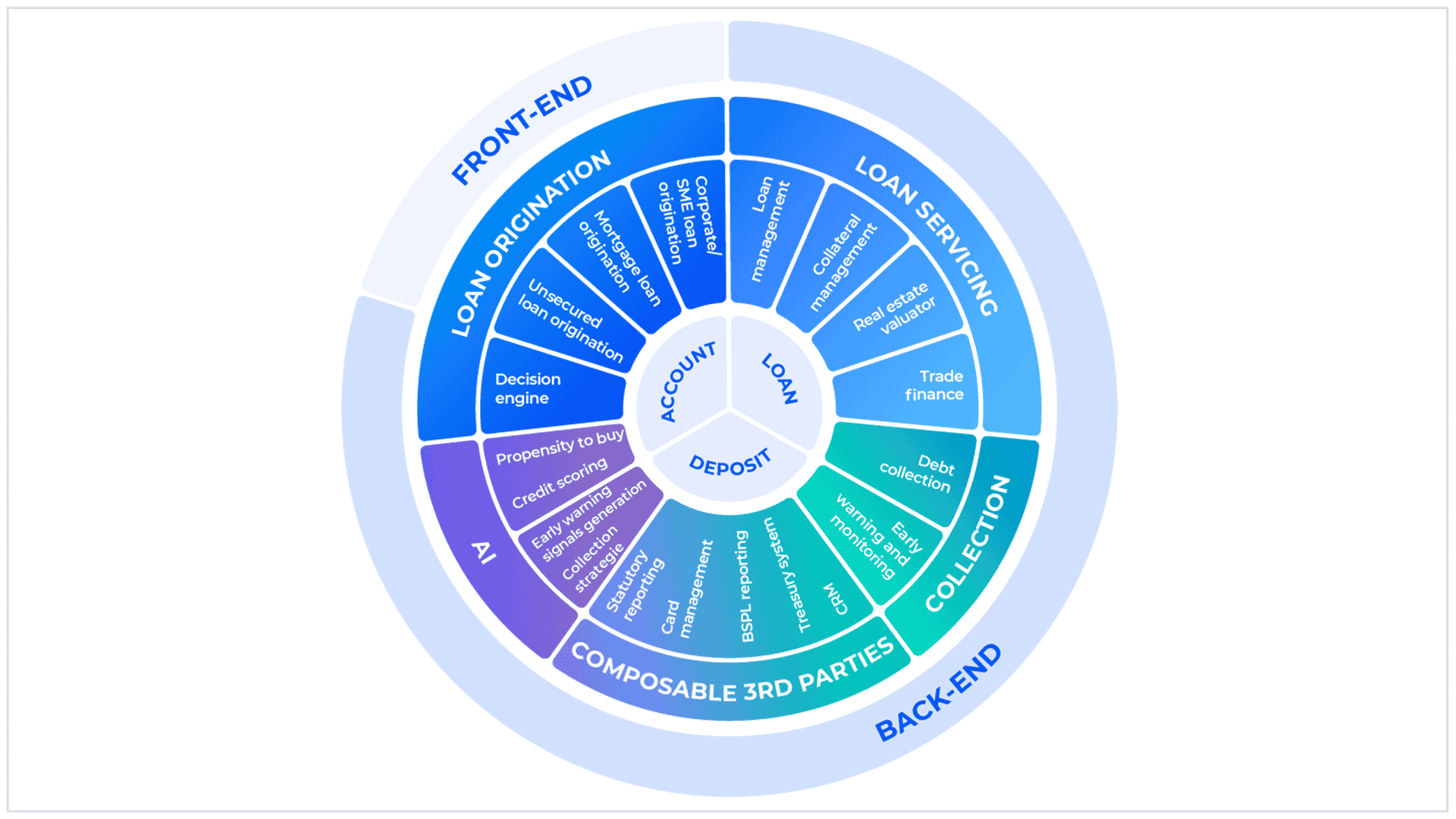

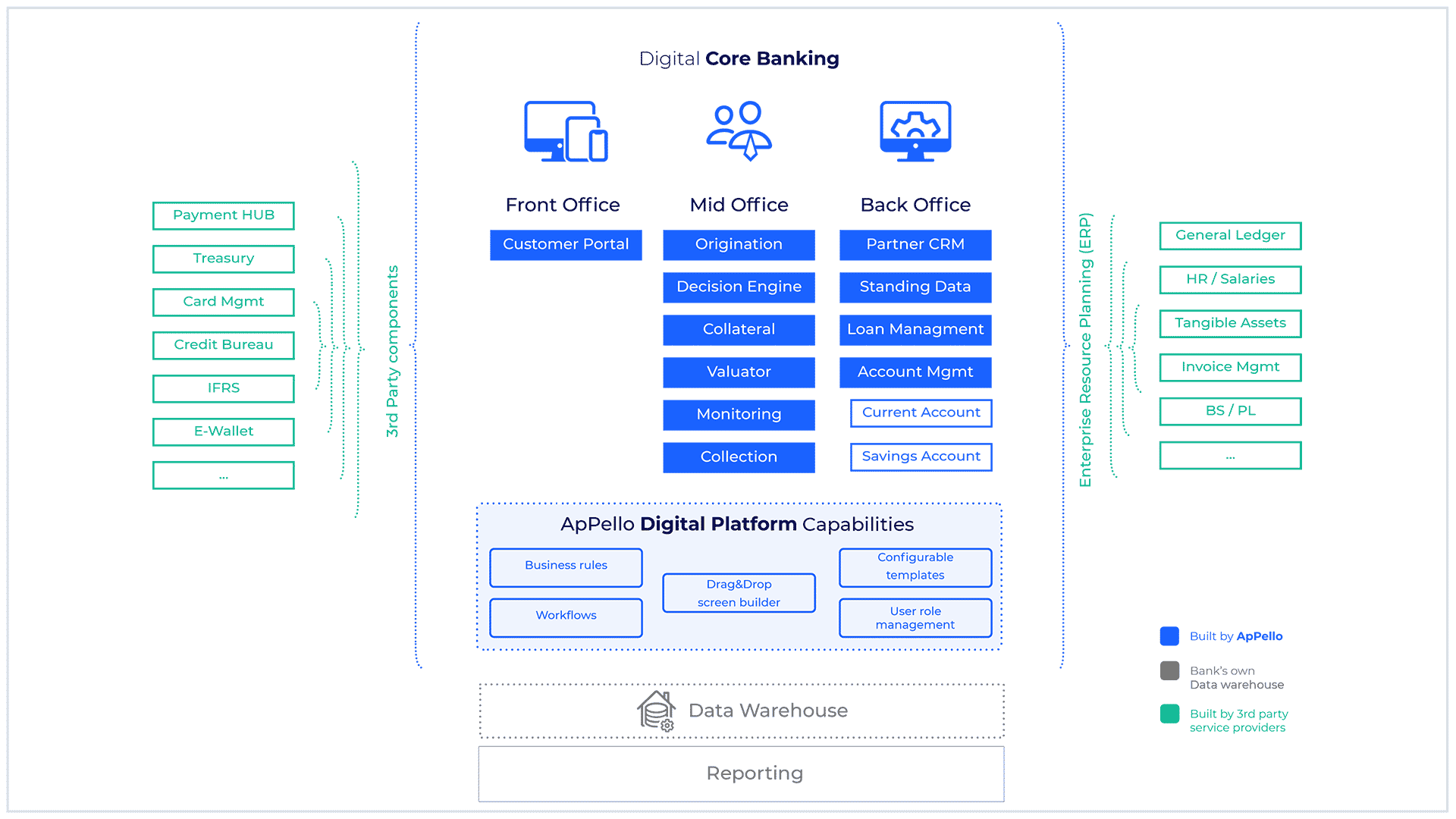

ApPello’s digital Core Banking System (CBS) is a state-of-the-art, cloud-based solution that caters to a wide range of banking functionalities, including current accounts, savings, and lending. Our CBS serves as the core engine, providing the foundation for efficient and secure banking operations.

To further enhance the capabilities of our Core Banking System, we offer the ApPello Digital Platform, which incorporates advanced AI tools and pre-integrated third-party solutions. This comprehensive ecosystem empowers banks to streamline processes, leverage automation, and drive innovation.

Discover

Product Details

ApPello’s Digital Core Banking System is designed to seamlessly scale and adapt to your business requirements, catering to retail, SME, and large corporate clients. This engine is bolstered by the ApPello Digital Lending Platform, which encompasses a comprehensive suite of features such as Onboarding and Lending Portal, Loan Origination, Decision Engine, Loan Management, Collateral Management, Valuator, Early Warning, and Debt Collection System. Together, these components form an end-to-end system that caters to all aspects of the banking process.

We offer our Digital Core Banking as both a Software-as-a-Service (SaaS) solution and an on-premise option, providing flexibility in deployment based on your preferences and infrastructure.

Our product set is cloud agnostic, meaning it can seamlessly integrate and enhance the native technologies of leading cloud providers such as AWS, Azure, and Google Cloud. By leveraging these cloud platforms, our Digital Core Banking System offers clients a range of competitive advantages, including enhanced scalability, reliability, security, and access to cutting-edge features and services.

Benefits

Powerful CBS engine for Retail, SME and Corporate business

Rapid configuration with Low Code Digital Platform

Flexibility – Enables configuration over customization

Extendable with ApPello Digital Lending Platform and 3rd party components

Cost Reduction – Minimal customization, integration and bespoke development

Scalable solution fits your business – Cloud-native

Complete

core banking toolset

ApPello Core Banking System is designed to assist you in reaching your business objectives, making it the perfect solution when combined with the ApPello Digital Lending Platform. With its microservice-based architecture, ApPello’s core banking solution effortlessly accommodates various agile product and business development strategies.

The system effectively handles current accounts, savings accounts, and loan accounts. For a comprehensive banking experience, the CBS can be complemented by the optional Digital Lending Platform front office, which prioritizes a seamless customer digital channel experience. Additionally, the back office component automates every step of the process, from origination to collection, streamlining operations for enhanced efficiency.

Core Banking

modules

Account Management (AMS) is a versatile tool for managing accounts and balances in multiple currencies, offering the added benefit of interest-bearing capabilities. This system seamlessly integrates with card management and loan management applications, fostering a cohesive banking environment. AMS facilitates essential functionalities such as authorisation holds, payment orders, overdrafts, and the accounting of economic events.

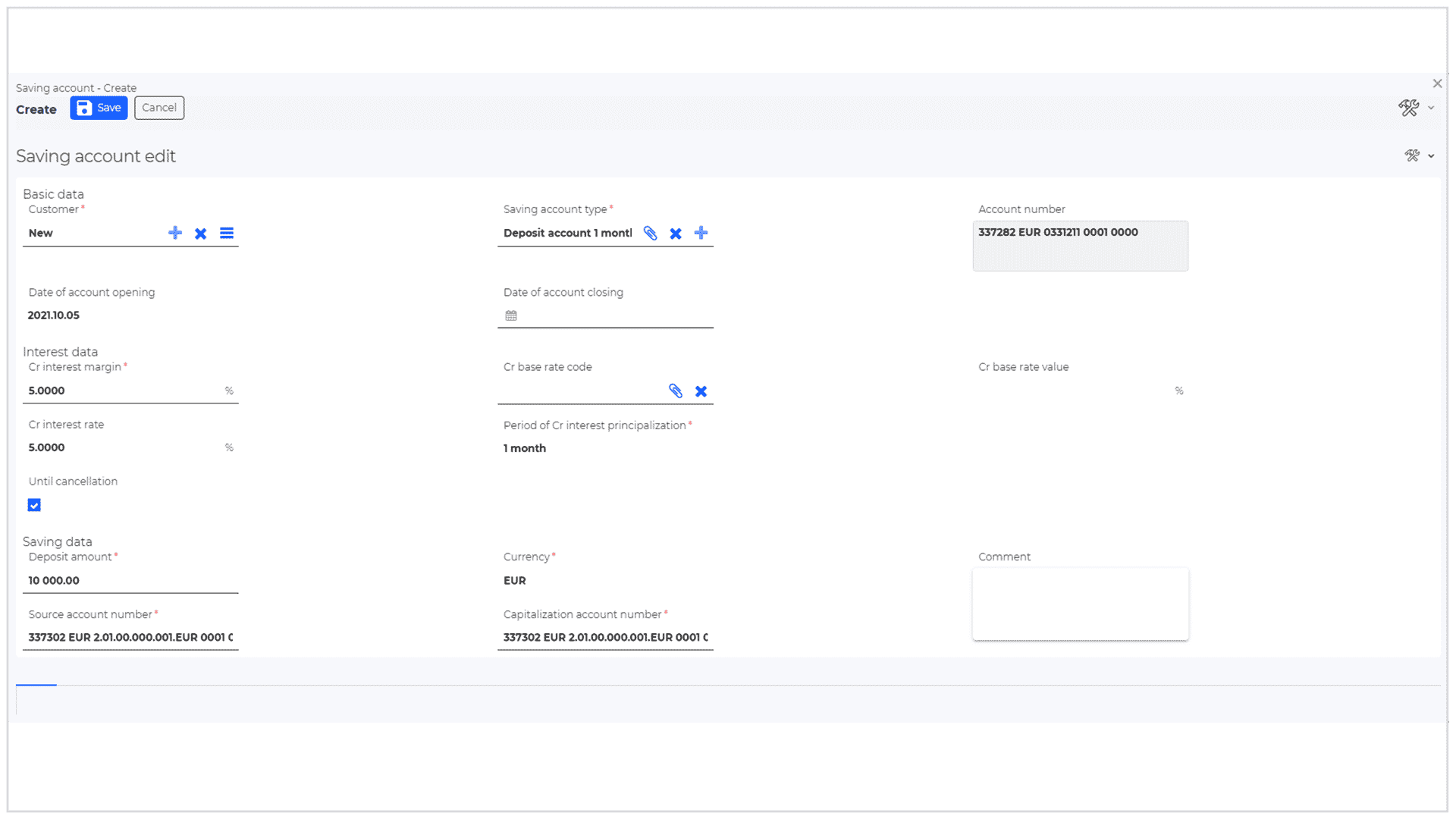

Moreover, Savings Management empowers users with customizable deposit and savings account options, supporting a wide range of interest and fee calculation choices.

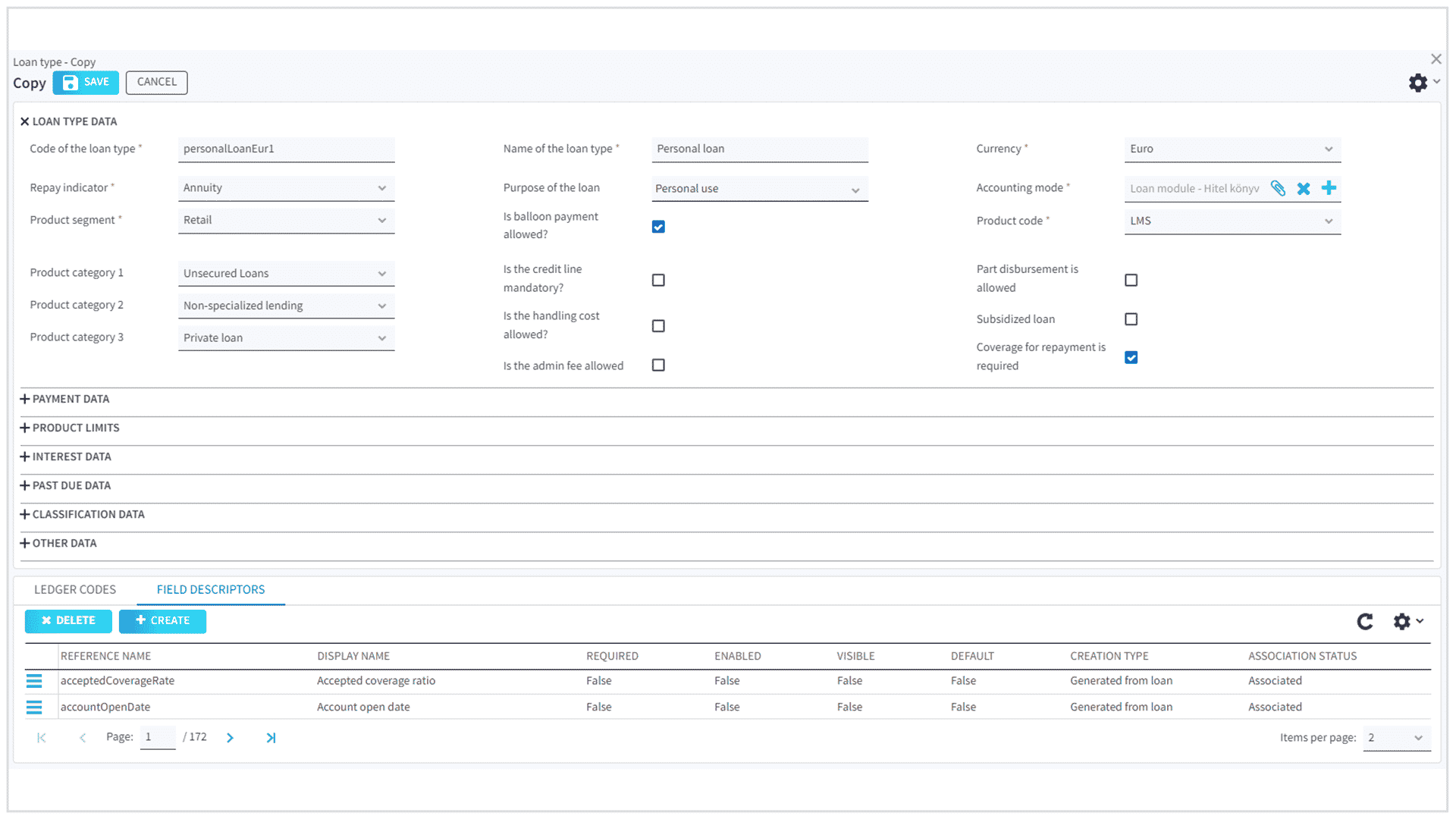

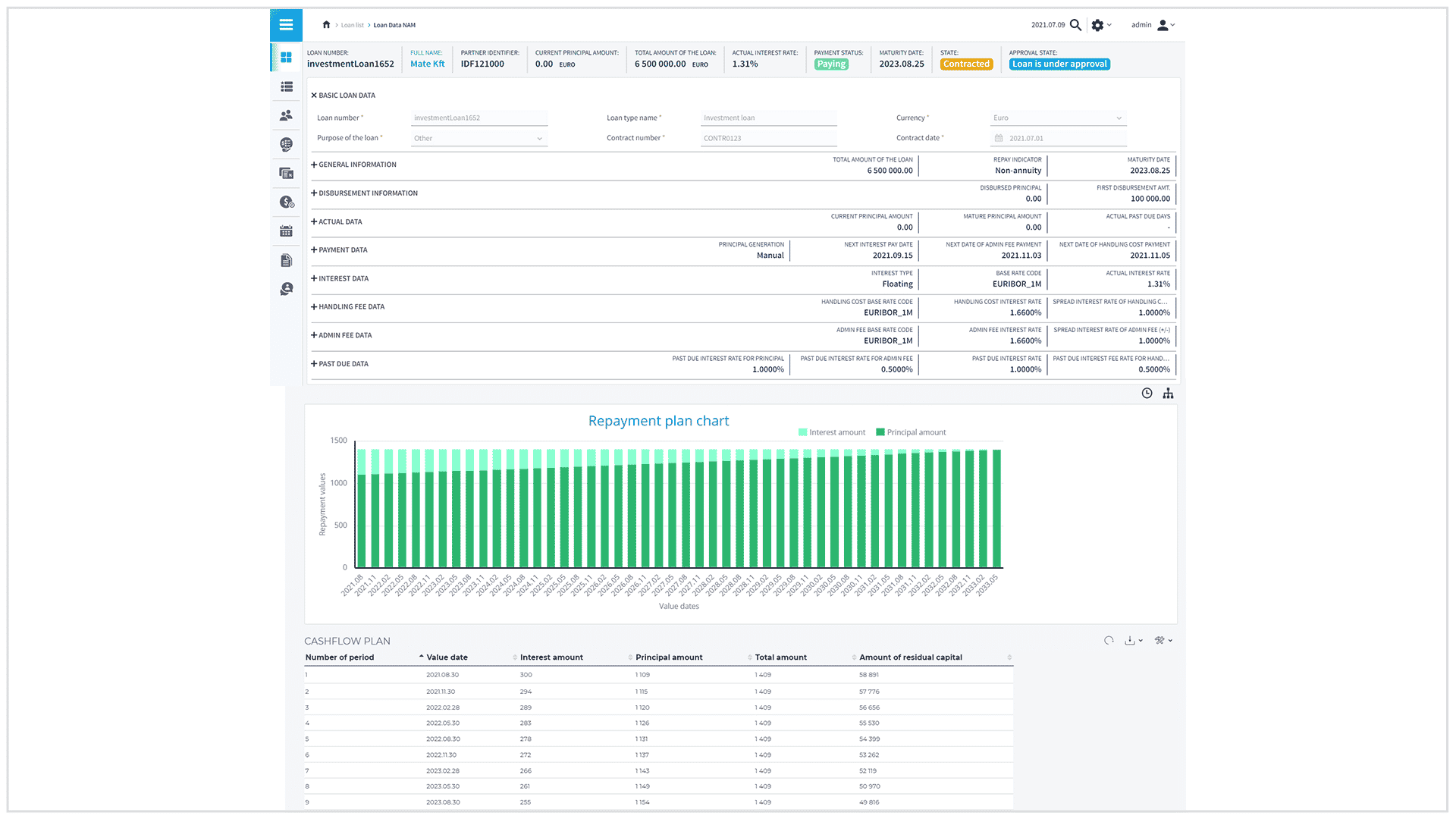

On the other hand, Loan Management (LMS) automates all stages of the loan process, spanning from disbursements to termination. This comprehensive application effectively handles administrative tasks and oversees all transactions associated with loans, providing a robust solution for banks.

More on Loan Management…

Speed up

time-to-market

Our solution offers extensive configurability, eliminating the requirement for additional customization and development. With an intuitive interface, you can effortlessly design, build, and maintain comprehensive business products and processes tailored to your specific needs.

By leveraging a diverse range of APIs, you can seamlessly integrate functionalities without the need for continuous code development or maintenance. The combination of configuration capabilities and easy API integration significantly reduces time to market, enabling swift deployment of your solution.

Configuration

over customization

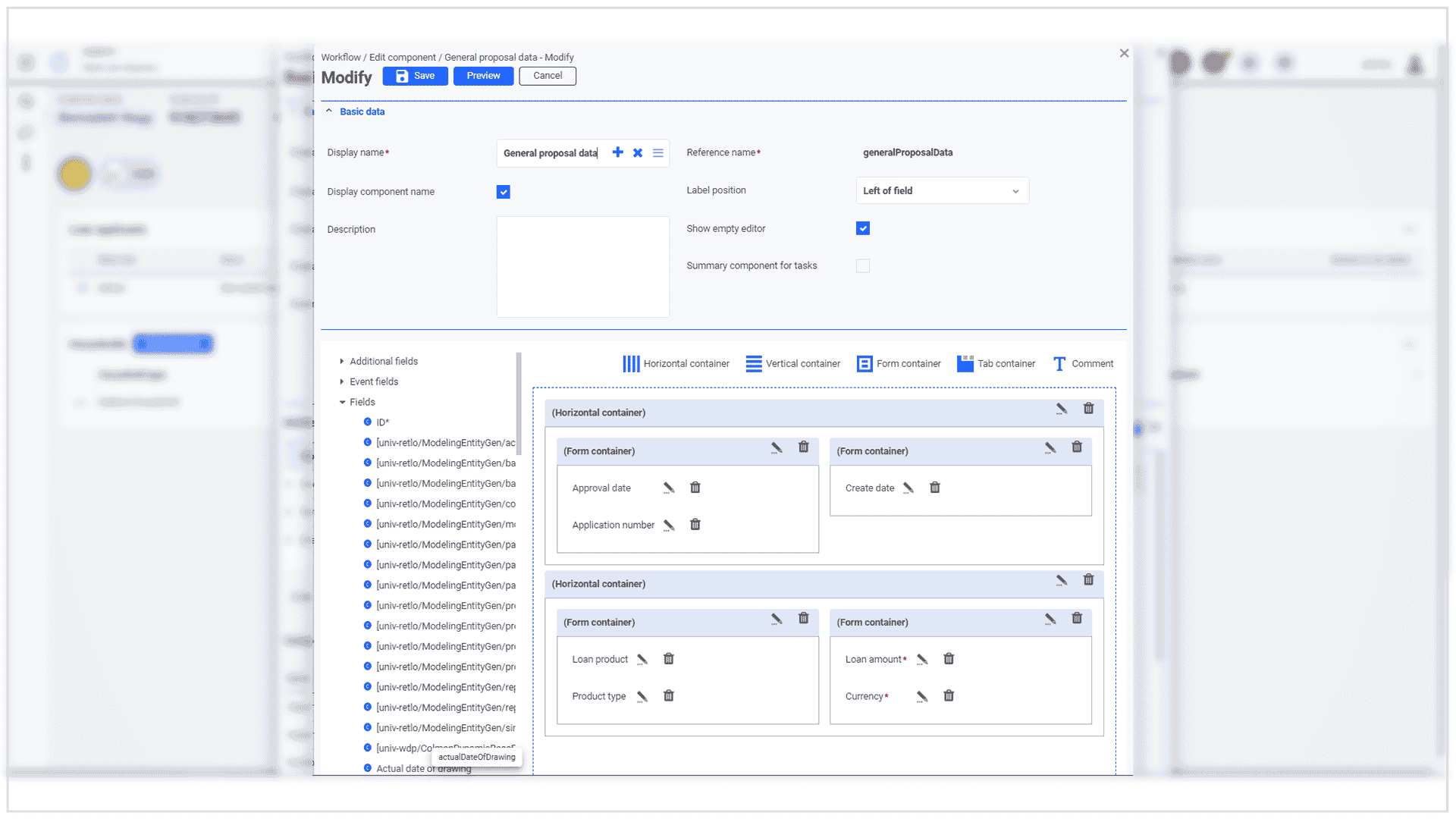

The system seamlessly integrates into your workflow, allowing for easy incorporation of its functions. With the convenience of drag-and-drop capability, configuring your workflow is a breeze, enabling you to design or completely re-design your flows within a matter of hours. Built-in dashboards and reports empower you to measure your effectiveness, such as product take-up, effortlessly. Furthermore, the workflow engine grants business users the ability to define and maintain workflows across different business modules, enhancing operational efficiency.

ApPello’s platform boasts flexible features that enable continuous fine-tuning of business rules and process flows. The optimized user experience is achieved through a drag-and-drop screen builder, empowering advanced users to set up and maintain workflows, configure business rules and screens, and modify page layouts independently. This level of flexibility streamlines the process of enhancing your product portfolio. You can easily configure a new product, conduct necessary tests, and launch new products in a matter of days rather than months. This innovative and unified suite of products is designed to assist your company in navigating the challenges of the ever-changing banking landscape, both now and in the future.

ApPello

Composable Solution

Our Digital Platform offers seamless integration capabilities, allowing financial institutions to connect effortlessly with various third-party applications, including payment hubs, treasury systems, card management systems, and more. This integration accelerates your business operations and enhances overall efficiency.

The platform comes pre-integrated with a wide range of solutions, approximately one hundred in total, enabling you to configure your solution according to your specific business needs and preferences. This extensive range of pre-integrated solutions provides flexibility and customization options, ensuring that your digital platform aligns perfectly with your requirements.

Operational cost

reduction

ApPello’s system is designed to be cloud agnostic, allowing it to seamlessly adapt to different cloud platforms. Leveraging the elasticity of the chosen cloud infrastructure, the system can deploy resources on demand rather than relying on fixed capacity. While we continue to provide full support for traditional on-premise installations, the cloud-native capabilities of the CBS bring additional advantages for clients embracing cloud deployments.

By harnessing the power of the cloud, clients can unlock even greater benefits with the ApPello system. The inherent scalability and flexibility of cloud environments enable efficient resource allocation and cost optimization. Embracing a cloud-native approach empowers organizations to leverage the latest technologies and services offered by their chosen cloud platform, resulting in enhanced performance, reliability, and agility.

Omnichannel

approach

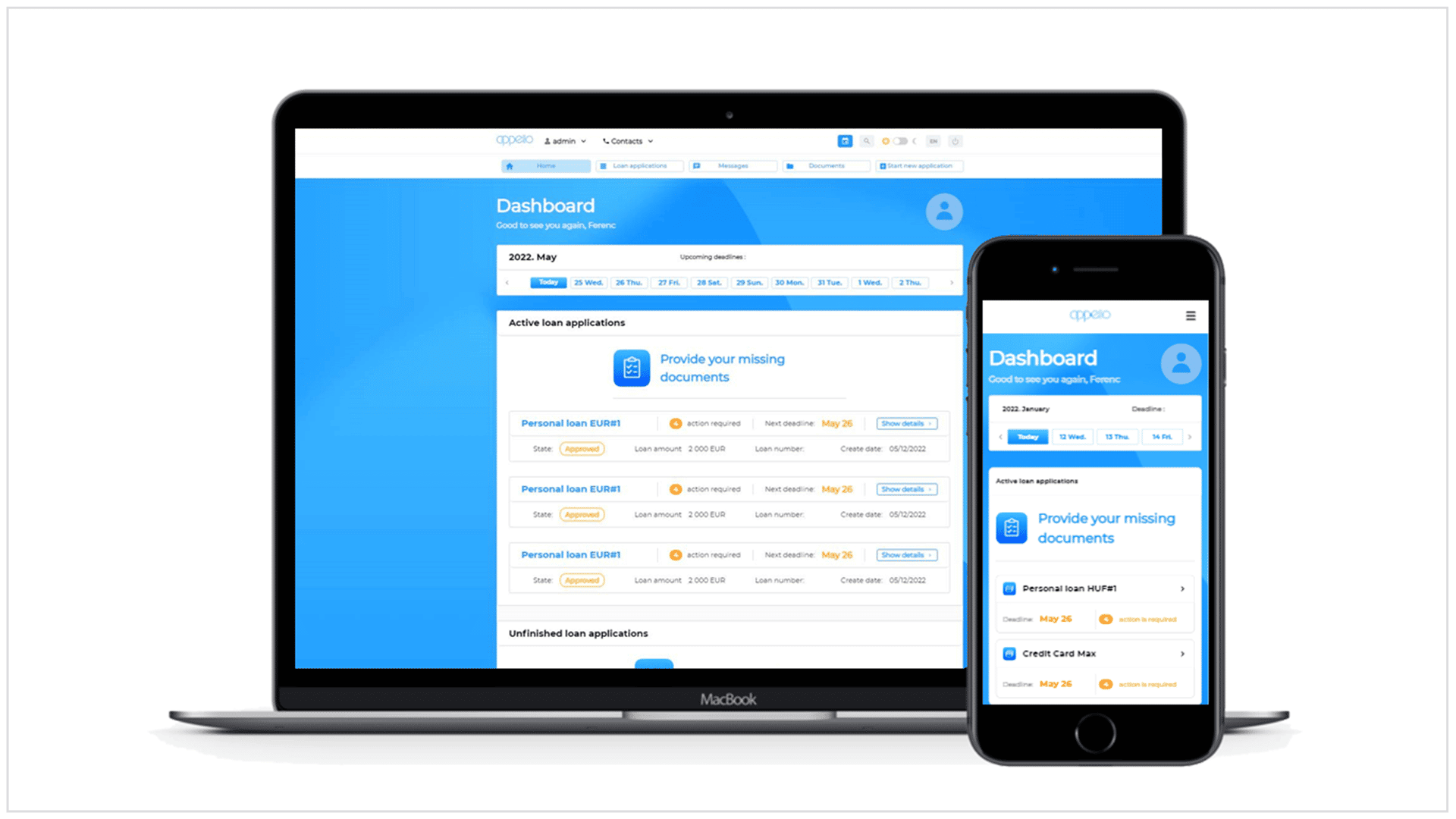

The seamless experience of both customers and internal staff necessitates an omnichannel mindset and toolset. To address this, our solution is thoughtfully designed with a mobile-first approach, considering the use of mobile devices and other corporate channels. The digital interface provided ensures a consistent and user-friendly experience across various touchpoints, empowering users to engage with the solution seamlessly, regardless of the channel they choose to interact with.

Related

Products

You might also be interested in our other lending solutions

Unsecured

Loan Origination

ApPello Loan Origination Solution is designed for banks and financial institutions to manage lending processes of unsecured retail loans.

Loan

Management

automates end-to-end loan lifecycle processes from creation of loan products to disbursements until termination. The platform is built on a state of the art technology to manage simple retail to complex corporate loans.