AI Engine for

Lending

ApPello’s AI Engine is a unique end-to-end modelling platform, that enables the rapid design and deployment of high performing AI models. The platform serves multiple scenarios across business units and helps institutions to make faster and smarter decisions.

Discover

Product Details

ApPello’s AI Engine allows organizations to easily use modern AI prediction models without the need for a large group of Data Scientists.

This world-class predictive analytics software serves several business scenarios and enables centralised tracking and management of all models.

AI portfolio

Propensity

to buy

The solution identifies potential additional customers who are likely to engage for a business offering, giving a competitive edge on the market. Using ApPello’s AI Engine for building propensity to buy models will help to minimize marketing expenditure, maximize potential for the addition of new customers and allows efforts to be concentrated on groups that matter most to a business.

Fraud

prevention

Besides credit risk, fraud risk is a significant factor of credit losses for a lending business. Fraudulent clients behave differently regarding frequency, concentration, severity of cases. AI is a perfect tool to detect fraudulent cases. Incorporation an AI based fraud prevention logic into the credit application process improves portfolio quality and supports validation and underwriting units.

Collection optimization

ApPello’s AI Engine helps to optimize end-to-end monitoring and collection processes and identifies delinquent customers significantly faster than traditional business models. It can instantly recommend actions based on the analysis of a customer’s behaviour and risk profile.

The customized collection process eventually results greater efficiency in average collection time and a reduction in unnecessary costs.

Churn

prevention

Efficient acquisition is only the first half of client protfolio growth. Retention is at least as important as acquisition. Investigating churn reasons and building an AI based churn prediction model can support business to improve client retention efficiency.

An improved AI based retention framework can even provide a best offer for the bank to prevent churn.

Benefits

Increased sales and retained customers, reduced risk

ApPello’s AI Engine serves a large variety of functions, from credit risk to propensity to buy and churn modelling

Reduced development and implementation costs

Our intuitive low code/no code environment and AutoML functions do not require a large group of Data Engineers

Rapid model development

AI models can be built quickly and easily and then deployed instantly, saving time and resources

Flexible integration and fast deployment

ApPello’s AI Engine can be integrated easily to any platform so there is no need to change legacy systems or applications.

Automated ML models

AutoML helps to build and select the best performing models to allow smarter decision making.

Low code/ no code environment

The low code/no code platform doesn’t require any special programming knowledge.

Process of

AI Engine

Import, explore & transform data

- Data import

- Data exploration/profiling

- Data Transformation

- Variable analysis

- Feature engineering

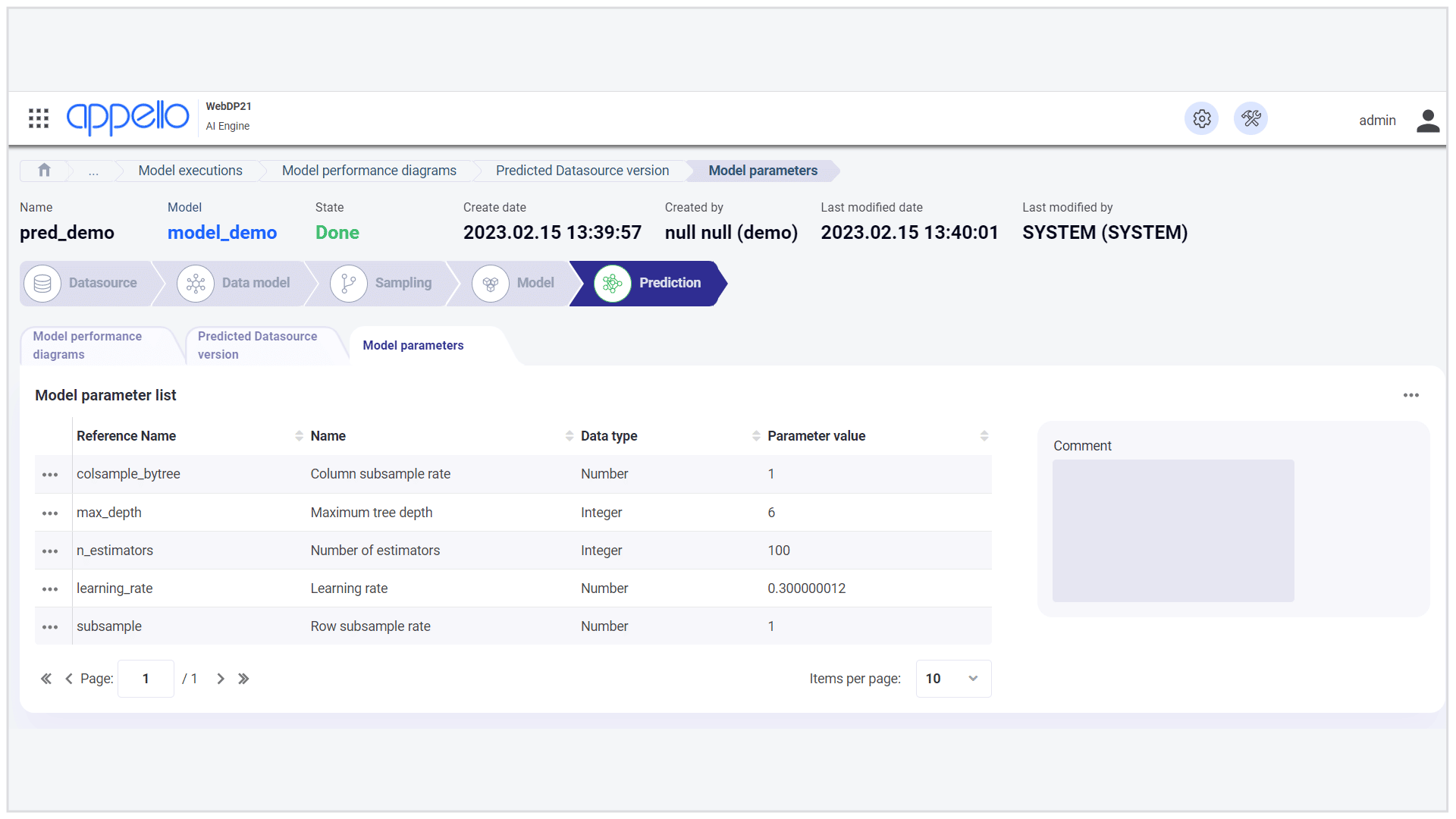

Create and compare models

- Setting target variables

- Sample Splitting

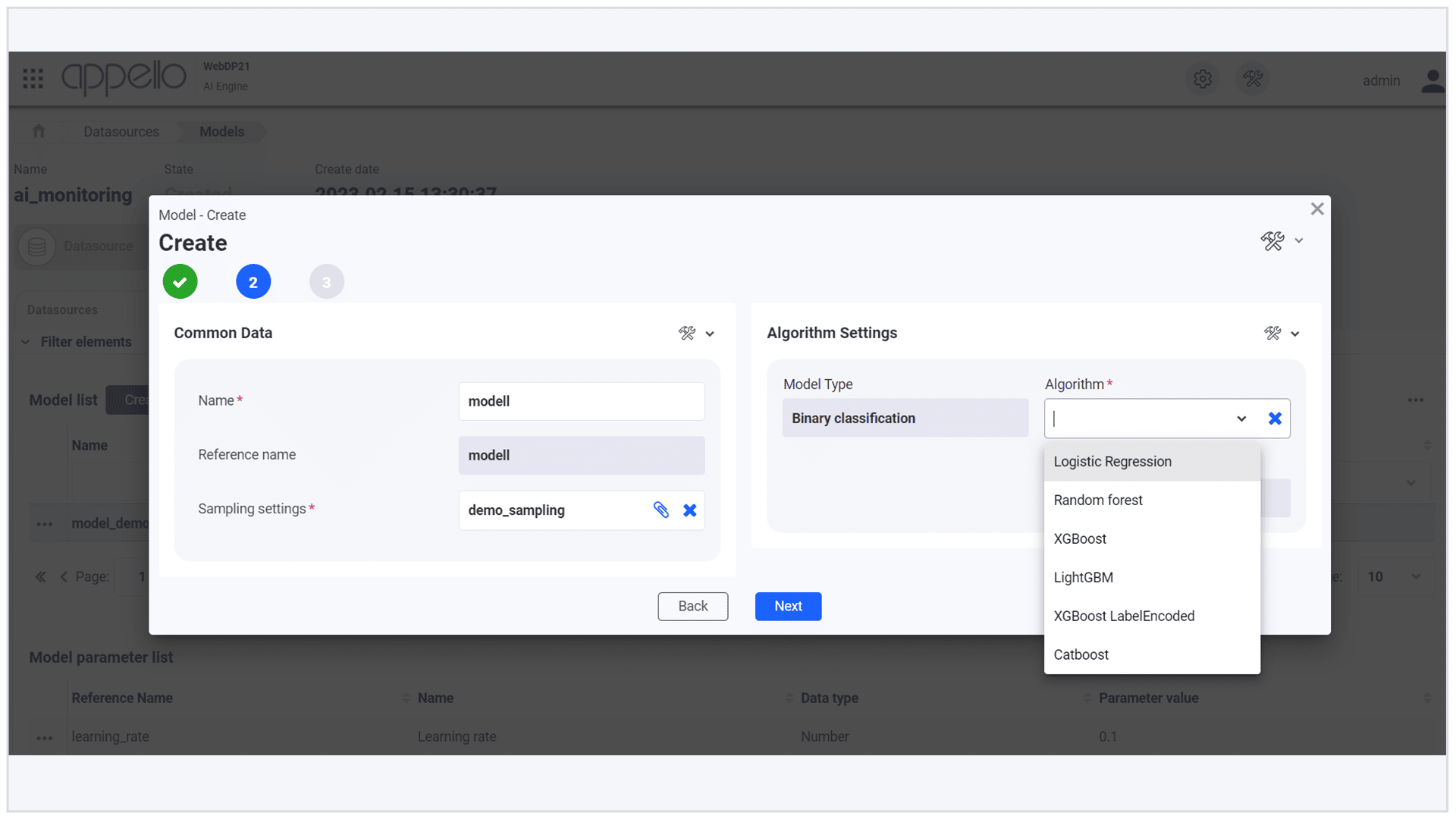

- Model selection

- Model parameter setting

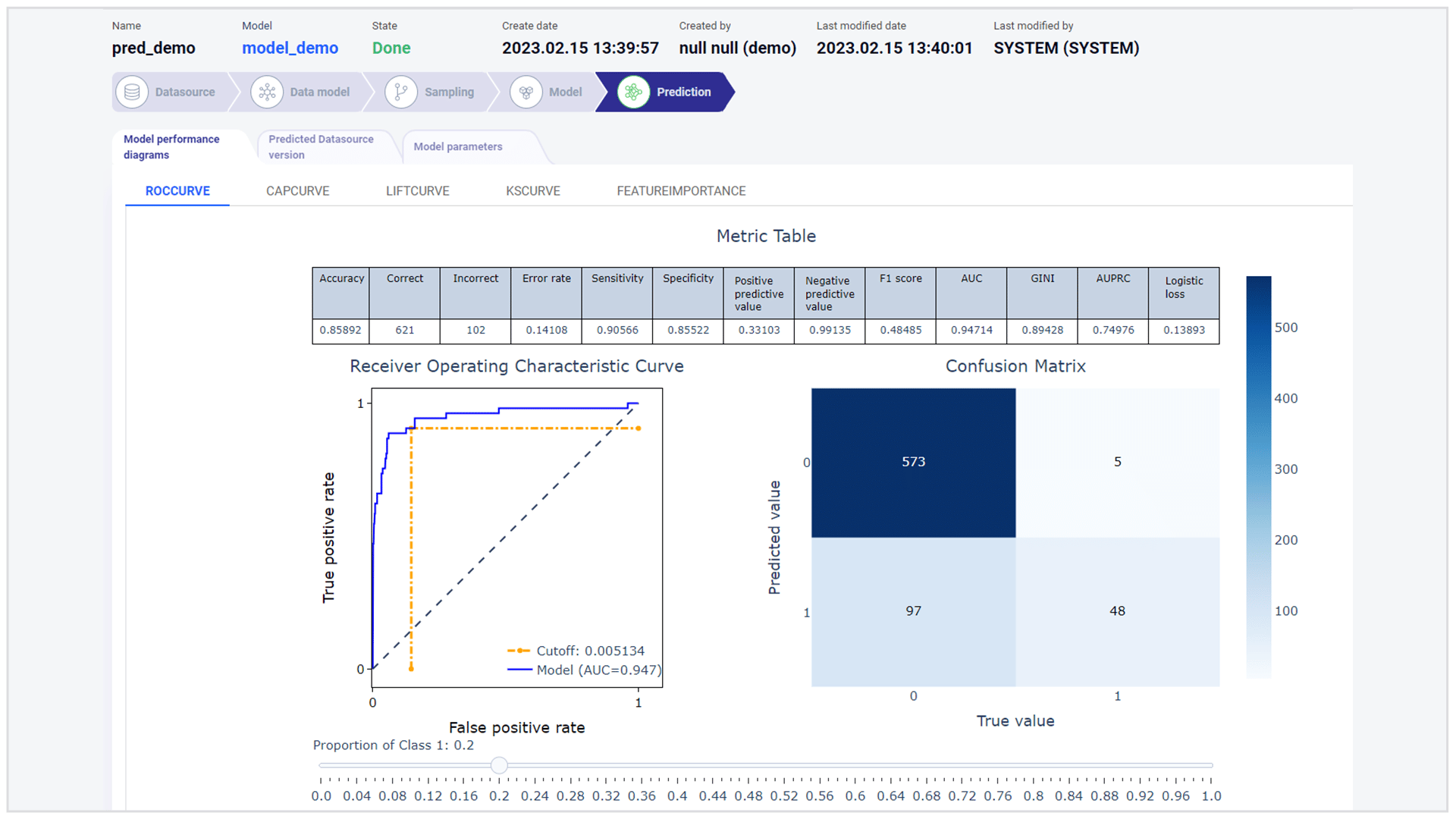

- Analyse results and performance

Interpreting models

- Charts, graphs, tables, ect.

- Explaining model algorithms

- Auto documentation

Deploying models

- Auto decisioning

Predictive

Analytics

ApPello’s AI Engine supports any kind of predictive analytics scenario. Simply create your business use case and let our world-class predictive modelling framework help you to make the best decision. Credit Scoring, Propensity to buy modelling or Churn modelling are only a few of the large number of business scenarios which have already been successfully tested and deployed within our platform.

Multiple

Data sources

The platform allows data to be loaded directly from data warehouses, cloud or any kind of external files. Flexible connection ensures the essence of the machine learning process, the continuous learning and optimal decision making.

Model

Configuration

Building reliable machine learning models can take up significant time and resources. ApPello’s AI engine simplifies the modelling processes by creating a low code/no code environment, where experts can quickly and easily parameterise and run AI models resulting in a significant reduction in the cost of development and implementation.

Model

performance

Organizations are keen to make the best possible decisions. ApPello’s AI Scoring platform enables users to compare models’ performance indicators side by side, then choose and deploy the best performing option.

Furthermore, we can track the lifecycle and monitor the performance of each model and intervene at the right time if necessary.

Flexible

Integration

ApPello’s AI Engine can be deployed anywhere, so it won’t require replacement of or amendment to legacy systems or the purchase of narrow AI applications. Simply deploy your models in your existing CRM, Loan origination or Monitoring systems and enjoy the benefits of your new intelligent application.

Related

Products

You might also be interested in our other lending solutions

Early Warning &

Monitoring

module is responsible for checking, among others, the terms & conditions of contracting and disbursement, and for early identification of future non-performance.

Debt

Collection

offers a debt management, collection

and recovery solution. Maximises operational efficiency, reduces the cost of collection and ensures the delivery of excellent customer services.